GBPAUD - D closed a hanging man doji at the end of a run up, typically signalling a move down. 4hr in a triangle and testing the lower trend line and also the 7 August high. Not sure which way we will react no bias.

EJ - D closed a doji, RSI under 50 level and we are below the 8lwma. The current 4hr open candle is testing the lows. I suspect down but we can react higher. Bias down.

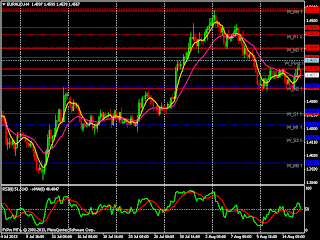

EURAUD - D closed negative to complete an evening star pattern off the 1.5000 resistance level. 4hr lower high lower low flow down. We are approaching a support level and then the W pivot at 1.4726. Below that the target could be the 16 August highs around 1.4625.

AUD - D closed a shooting star failing to go lower, 0.8900 held. 4hr has signalled a counter trend buy with RSI cross up. It remains to see whether this is anything other than a rally in a downtrend. With the current troubles facing the world its quite likely that the flight to safety, typically to the US$, will continue.

All the world's a stage and we are merely players. Discipline is the bridge between goals and accomplishment.

Friday, August 30, 2013

Thursday, August 29, 2013

29 August 2013

GBPAUD - Yesterdays bias up played out as did the resistance level with moves up getting rejected around 1.7470 and the D closed another shooting star. 4hr crossed lower yesterday signalling scalp sells. The lower end of the higher high higher low flow is just about holding. The 1hr is on a lower high. Don't know which will win, a move lower would target 1.7200 and a move higher 1.7480. I suspect a little more downside but a move up would be no surprise at all, no bias.

EJ - The oversized negative candle on 27th did not follow through immediately as mentioned, the D closed a large body doji. The area 129.60 gave support in the week of 31 July, 15 and 20 Aug. I suspect down but a move up again no surprise, no bias.

EURAUD - Bias up did not play out as the 1.5000 resistance level held, D closed a shooting star. Asian session moved down strongly on a 4hr lower high. The next support level is around 1.4750/70.

AUD - The strong Asian move down yesterday did not follow through lower W S1 held and the D closed negative with a lower wick again. 4hr RSI crossed higher for a counter trend buy signal moving up to the (from 26 August high) 50% fib/W M2 area. No bias.

EJ - The oversized negative candle on 27th did not follow through immediately as mentioned, the D closed a large body doji. The area 129.60 gave support in the week of 31 July, 15 and 20 Aug. I suspect down but a move up again no surprise, no bias.

EURAUD - Bias up did not play out as the 1.5000 resistance level held, D closed a shooting star. Asian session moved down strongly on a 4hr lower high. The next support level is around 1.4750/70.

AUD - The strong Asian move down yesterday did not follow through lower W S1 held and the D closed negative with a lower wick again. 4hr RSI crossed higher for a counter trend buy signal moving up to the (from 26 August high) 50% fib/W M2 area. No bias.

Wednesday, August 28, 2013

28 August 2013

GBPAUD - The D closed a shooting star after the base at 1.7200 held. Asian session moved up strongly again today, higher high higher low flow in tact. It might be tough going but the previous highs 1.7480 should be a target. Bias up but we are approaching a major resistance level.

EJ - D closed negative in line with the bias with the kind of over sized candle that does not always follow through immediately. Bias down but there appears to be a significant retrace up that will need to work its way out.

EURAUD - D closed positive and Asian session moved up strongly to hit the 1.5000 target. Whilst we'll need to see the reaction at London open so far the price action does not indicate we are going lower. Bias up.

AUD - D closed negative with a lower wick bouncing from last weeks lows. Bias down target should be the lows 0.8840.

EJ - D closed negative in line with the bias with the kind of over sized candle that does not always follow through immediately. Bias down but there appears to be a significant retrace up that will need to work its way out.

EURAUD - D closed positive and Asian session moved up strongly to hit the 1.5000 target. Whilst we'll need to see the reaction at London open so far the price action does not indicate we are going lower. Bias up.

AUD - D closed negative with a lower wick bouncing from last weeks lows. Bias down target should be the lows 0.8840.

Tuesday, August 27, 2013

27 Aug 2013

GBPAUD - D closed a small range doji. 4hr shows clearly the base at 1.7200 holding. Asian session moved up strongly. The previous highs 1.7480 should be a target.

EJ - D closed negative the upper resistance level around the July highs holding. Asian session moved down strongly, bias down.

EURAUD - D closed a doji. Asian session moved up strongly. The previous highs 1.5000 should be a target.

AUD - D closed a doji. Asian session moved down strongly. Bias down target should be the lows 0.8840.

EJ - D closed negative the upper resistance level around the July highs holding. Asian session moved down strongly, bias down.

EURAUD - D closed a doji. Asian session moved up strongly. The previous highs 1.5000 should be a target.

AUD - D closed a doji. Asian session moved down strongly. Bias down target should be the lows 0.8840.

Monday, August 26, 2013

26 Aug 2013

GBPAUD - D closed negative with sell divergence, still on higher high higher low. 4hr has a base at 1.7200 and is on a lower high. 4hr suggests down, not convinced about D. No bias.

EJ - D closed positive but virtually no follow through from Thursdays range break, no doubt due to the upper resistance level. 4hr divergence right at the highs and RSI crossed lower. There is a base around 131.90 bias up.

EURAUD - D closed a doji, 4hr on a lower high. Short term bias down.

AUD - D closed positive, struggling with the 0.9050 resistance area. Short term bias up.

EJ - D closed positive but virtually no follow through from Thursdays range break, no doubt due to the upper resistance level. 4hr divergence right at the highs and RSI crossed lower. There is a base around 131.90 bias up.

EURAUD - D closed a doji, 4hr on a lower high. Short term bias down.

AUD - D closed positive, struggling with the 0.9050 resistance area. Short term bias up.

Sunday, August 25, 2013

Friday, August 23, 2013

23 Aug 2013

A change this morning on the pairs being analysed.

A good example between when I haven't really got a clue whats happening and have no bias and like today where we are on a knife edge and I'd be happy to trade either direction but because of that have no bias.

GBPAUD - D closed negative RSI still above 50 level. 4hr yesterday had an evening star pattern, RSI cross lower which did follow through. We have moved into the general area of the 5 Aug highs that may act as support. Can go either way today so no bias, will be happy to consider good candles in either direction..

EJ - D closed positive on the back of 2 x 1hr higher low 3 bar reversals, after London open and US open. Bias up.

EURAUD - D closed negative when the move above 1.4900 was quickly rejected in Asian session. The upper wicks yesterday during London morning on 1hr showing any move up was sold off. For this pair the move lower was not that large so there are buyers around still. D RSI did not cross lower and we are still above the 8lwma (that is due to 2 very large positive closes earlier this week and ma catching up). 4hr is on a lower high and if we turn positive from here a higher low. No bias but would have no problem with flow moving in either direction.

AUD - A very similar mirrored position to EURAUD.

A good example between when I haven't really got a clue whats happening and have no bias and like today where we are on a knife edge and I'd be happy to trade either direction but because of that have no bias.

GBPAUD - D closed negative RSI still above 50 level. 4hr yesterday had an evening star pattern, RSI cross lower which did follow through. We have moved into the general area of the 5 Aug highs that may act as support. Can go either way today so no bias, will be happy to consider good candles in either direction..

EJ - D closed positive on the back of 2 x 1hr higher low 3 bar reversals, after London open and US open. Bias up.

EURAUD - D closed negative when the move above 1.4900 was quickly rejected in Asian session. The upper wicks yesterday during London morning on 1hr showing any move up was sold off. For this pair the move lower was not that large so there are buyers around still. D RSI did not cross lower and we are still above the 8lwma (that is due to 2 very large positive closes earlier this week and ma catching up). 4hr is on a lower high and if we turn positive from here a higher low. No bias but would have no problem with flow moving in either direction.

AUD - A very similar mirrored position to EURAUD.

Thursday, August 22, 2013

22 Aug 2013

EUR - The June high resistance level won out and D closed negative partly on the back of the FOMC statement. D showing negative divergence but still on higher high higher low. If the US news was such a game changer why not a stronger reaction lower? We can go either way no bias.

GU - Did nothing for the day until the FOMC statement which started a move down and D closed a doji, small range. D negative divergence. Asian session followed through lower breaking the 4hr higher high higher low flow. 4hr negative divergence. We can go either way but I suspect down.

EJ - Another day of sideways drift, D closing a shooting star respecting the upper range. Asian session moved up strongly to test 131.00. I suspect up but no bias.

EA - D closed positive on the back of the FOMC statement. 4hr higher high higher low with negative divergence. The 1.4900/5000 resistance area may win out, 4hr may be running out of steam but bias up until flow confirms otherwise.

AUD - D closed negative, 4hr remains lower high lower low. We have bounced up from the same area that had the higher low on 7 Aug (clear from 4hr), I suspect a rally in down trend. Bias down.

GU - Did nothing for the day until the FOMC statement which started a move down and D closed a doji, small range. D negative divergence. Asian session followed through lower breaking the 4hr higher high higher low flow. 4hr negative divergence. We can go either way but I suspect down.

EJ - Another day of sideways drift, D closing a shooting star respecting the upper range. Asian session moved up strongly to test 131.00. I suspect up but no bias.

EA - D closed positive on the back of the FOMC statement. 4hr higher high higher low with negative divergence. The 1.4900/5000 resistance area may win out, 4hr may be running out of steam but bias up until flow confirms otherwise.

AUD - D closed negative, 4hr remains lower high lower low. We have bounced up from the same area that had the higher low on 7 Aug (clear from 4hr), I suspect a rally in down trend. Bias down.

Wednesday, August 21, 2013

21 Aug 2013

EUR - Yesterday a move lower into London open failed with 1hr showing a positive close candle with a large lower wick. D closed positive. 4hr higher high higher low in tact. We are at the June highs1.3420 and whilst we can react lower from this level bias up.

GU - D closed positive on a low range. 4hr higher high higher low, seems like a struggle to move up, RSI crossed lower giving a counter D trend sell signal. Support found this morning around last weeks highs 1.5650. Bias up but the 1hr could flip over and give a lower high.

EJ - D closed positive, above 8lwma and above RSI 50 level but within the upper range 130.50. 4hr above 8lwma RSI 50 level but a struggle to move higher. I suspect up but no bias.

EA - D closed positive mainly on the back of a strong Asian push up. After London open when AUD moved up also, to break their opposite correlation EA struggled. Moved up cleanly again in Asian session when the AUD resumed down trend. We are again within striking distance of the major level 1.5000. Bias up.

AUD - D closed negative with a lower wick. 4hr lower high lower low in tact. Bias down.

GU - D closed positive on a low range. 4hr higher high higher low, seems like a struggle to move up, RSI crossed lower giving a counter D trend sell signal. Support found this morning around last weeks highs 1.5650. Bias up but the 1hr could flip over and give a lower high.

EJ - D closed positive, above 8lwma and above RSI 50 level but within the upper range 130.50. 4hr above 8lwma RSI 50 level but a struggle to move higher. I suspect up but no bias.

EA - D closed positive mainly on the back of a strong Asian push up. After London open when AUD moved up also, to break their opposite correlation EA struggled. Moved up cleanly again in Asian session when the AUD resumed down trend. We are again within striking distance of the major level 1.5000. Bias up.

AUD - D closed negative with a lower wick. 4hr lower high lower low in tact. Bias down.

Tuesday, August 20, 2013

20Aug 2013

EUR - D closed another doji with the upper resistance level 1.3380 holding. We are above D and 4hr RSI 50 level and above the moving averages so bias should be up but this can go either way. There should be better opportunities elsewhere. No bias.

GU - D closed positive with the upper resistance level holding, still on higher high higher low. 4hr negative divergence. Bias should be up for same reasons as EUR but this can go either way. No bias.

EJ - D closed a shooting star, the move above the recent range strongly rejected. No bias.

EA - D positive close, engulfing candle. Asian session moved up strongly this morning. Bias up.

AUD - D closed negative, engulfing candle. Asian session has pushed lower to the area of the lows 3-15 July. Bias down.

GU - D closed positive with the upper resistance level holding, still on higher high higher low. 4hr negative divergence. Bias should be up for same reasons as EUR but this can go either way. No bias.

EJ - D closed a shooting star, the move above the recent range strongly rejected. No bias.

EA - D positive close, engulfing candle. Asian session moved up strongly this morning. Bias up.

AUD - D closed negative, engulfing candle. Asian session has pushed lower to the area of the lows 3-15 July. Bias down.

Monday, August 19, 2013

19 Aug 2013

EUR - D closed a negative doji rejecting the upper resistance level, potentially forming right shoulder on a head and shoulders pattern, still above the 8lwma and RSI 50 level. 4hr on higher high higher low. The W pivot is just above the 1.3300 support level and we'll need to see the reaction there.

GU - D closed with a very small range, Thurs large candle not following through. 4hr showing negative divergence. Whilst we could fall bias remains up.

EJ - Sideways for almost the whole week in the 129.50 - 130.50 range. No bias.

EA - D closed negative at the lows of recent range, which we are testing at the moment. We can bounce up from support but bias down.

AUD - D closed positive at the highs of recent range, which we are testing at the moment. We can move down from resistance but bias up.

GU - D closed with a very small range, Thurs large candle not following through. 4hr showing negative divergence. Whilst we could fall bias remains up.

EJ - Sideways for almost the whole week in the 129.50 - 130.50 range. No bias.

EA - D closed negative at the lows of recent range, which we are testing at the moment. We can bounce up from support but bias down.

AUD - D closed positive at the highs of recent range, which we are testing at the moment. We can move down from resistance but bias up.

Friday, August 16, 2013

16 Apr 2013

We typically do not trade on a Friday morning experiencing a fair amount of chop.

EUR - US news resulted in a significant move up and an engulfing D close. There is no way of knowing when news follows through or retraces. The 4hr chart is zoomed out a little to see some of the recent support/resistance levels.

GU - D closed positive on the back of the news push. 4hr higher high higher low remains in tact. The next D resistance level higher is the June highs in the area 1.5730.

EJ - D closed a doji. 4hr shows the chop between W pivots/support and resistance levels. No bias.

EA - D closed positive. 4hr broke the lower high lower low flow, retracing 100 pips lower in Asian session. No bias.

AUD - D closed a doji. 4hr not showing a flow that I can see. No bias.

EUR - US news resulted in a significant move up and an engulfing D close. There is no way of knowing when news follows through or retraces. The 4hr chart is zoomed out a little to see some of the recent support/resistance levels.

GU - D closed positive on the back of the news push. 4hr higher high higher low remains in tact. The next D resistance level higher is the June highs in the area 1.5730.

EJ - D closed a doji. 4hr shows the chop between W pivots/support and resistance levels. No bias.

EA - D closed positive. 4hr broke the lower high lower low flow, retracing 100 pips lower in Asian session. No bias.

AUD - D closed a doji. 4hr not showing a flow that I can see. No bias.

Thursday, August 15, 2013

15 Aug 2013

15 Aug 2013

EUR - The move lower yesterday failed and the support level at W S1 1.3248 held, the D closed a doji.. A move higher in Asian session failed to go above 1.3300 which is also a key level. Can go either way, no bias.

GU - D closed positive with a large upper wick, RSI above 50 level. 4hr on a higher low RSI above 50 level. Suggests bias up. We have last weeks high in the region of the proven resistance area from the Apr/May '13 highs and W M3. If trend and support and resistance are the 2 most important concepts in trading then we are in uptrend bumping up against a resistance level. If buying I'd be looking to get some space between entry and resistance area and get stop to break even as soon as possible. No bias.

EJ - D closed a doji and still on a lower high, hasn't crossed its upper trend line so its possible a rally in down trend. 4hr negative divergence, RSI crossed below signal line. We are possibly at a support/resistance area see 29-31 July and 6-9 Aug. No bias could go either way.

EA - D closed a doji, RSI below 50. 4hr looks like it has returned to lower high lower low. Bias down.

AUD - D closed a doji, RSI above 50. 4hr higher low. Bias up.

EUR - The move lower yesterday failed and the support level at W S1 1.3248 held, the D closed a doji.. A move higher in Asian session failed to go above 1.3300 which is also a key level. Can go either way, no bias.

GU - D closed positive with a large upper wick, RSI above 50 level. 4hr on a higher low RSI above 50 level. Suggests bias up. We have last weeks high in the region of the proven resistance area from the Apr/May '13 highs and W M3. If trend and support and resistance are the 2 most important concepts in trading then we are in uptrend bumping up against a resistance level. If buying I'd be looking to get some space between entry and resistance area and get stop to break even as soon as possible. No bias.

EJ - D closed a doji and still on a lower high, hasn't crossed its upper trend line so its possible a rally in down trend. 4hr negative divergence, RSI crossed below signal line. We are possibly at a support/resistance area see 29-31 July and 6-9 Aug. No bias could go either way.

EA - D closed a doji, RSI below 50. 4hr looks like it has returned to lower high lower low. Bias down.

AUD - D closed a doji, RSI above 50. 4hr higher low. Bias up.

Wednesday, August 14, 2013

14 Aug 2013

EUR - D closed negative, 4hr lower high lower low. We have a support level at W S1 1.3248. Other than a reaction up from there bias down.

GU - D closed a shooting star. It looks like a big news spike and if not a very low range day. Don't know if its quiet ahead of the MPC interest rate vote this morning. Bias would be down but with the news can go either way.

EJ - D closed positive in the resistance area 130.50. D is still on a lower high and hasn't crossed its upper trend line so its possible a rally in down trend. 4hr on higher high higher low. Bias up but a 4hr negative close here below 130.00 might signal move down.

EA - D small range shooting star reflected in the 4hr sideways move. Each 4hr candle of the last 7 is making marginally higher lows I seem to recall from somewhere that if we go up could be start of big move. I suppose the key word there is IF. I suspect up but can go either way no bias.

AUD - D closed negative with a lower wick. 4hr shows the move down but not that convincing. 1hr had lots of lower wicks yesterday until the US open move lower. Bias down.

GU - D closed a shooting star. It looks like a big news spike and if not a very low range day. Don't know if its quiet ahead of the MPC interest rate vote this morning. Bias would be down but with the news can go either way.

EJ - D closed positive in the resistance area 130.50. D is still on a lower high and hasn't crossed its upper trend line so its possible a rally in down trend. 4hr on higher high higher low. Bias up but a 4hr negative close here below 130.00 might signal move down.

EA - D small range shooting star reflected in the 4hr sideways move. Each 4hr candle of the last 7 is making marginally higher lows I seem to recall from somewhere that if we go up could be start of big move. I suppose the key word there is IF. I suspect up but can go either way no bias.

AUD - D closed negative with a lower wick. 4hr shows the move down but not that convincing. 1hr had lots of lower wicks yesterday until the US open move lower. Bias down.

Tuesday, August 13, 2013

13 Aug 2013

EUR - D closed a large body doji, below 8lwma and RSI crossed signal line lower but still above 50 level. 4hr is at a key level potentially on a lower high and a higher low if bounce off W M2 1.3286 confirms. The move lower could be a 15/85 trade. 1hr shows the higher low in Asian session. No bias can go either way.

GU - D closed negative for the 2nd day but still cannot close below the 8lwma. This is because of the over sized candle on 7 Aug, in simple terms 1 good day up then 2 days down cannot cause cross lower. Move down looks very weak. 4hr on open candle looks like it wants to reverse but 1hr still on lower high lower low. Bias down until flow reverses up, this could happen in area of W pivot 1.5426.

EJ - D closed positive with positive divergence. 4hr could not follow through lower yesterday giving a higher low 3 bar reversal positive close off W M2 128.27. Moved up during Asian session and now back in the support/resistance area 129.50 that started the move lower on 9 Aug. No bias can go either way.

EURAUD - D closed positive well below 8lwma/RSI cross. 4hr made a higher low. 1hr about to close on a lower high and close to reversing flow down. No bias can go either way. It appears the positive close may just be rally in down trend.

AUD - D closed negative but could not cause 8lwma cross, 4hr the opposite closing positive but could not cause cross. No bias can go either way.

GU - D closed negative for the 2nd day but still cannot close below the 8lwma. This is because of the over sized candle on 7 Aug, in simple terms 1 good day up then 2 days down cannot cause cross lower. Move down looks very weak. 4hr on open candle looks like it wants to reverse but 1hr still on lower high lower low. Bias down until flow reverses up, this could happen in area of W pivot 1.5426.

EJ - D closed positive with positive divergence. 4hr could not follow through lower yesterday giving a higher low 3 bar reversal positive close off W M2 128.27. Moved up during Asian session and now back in the support/resistance area 129.50 that started the move lower on 9 Aug. No bias can go either way.

EURAUD - D closed positive well below 8lwma/RSI cross. 4hr made a higher low. 1hr about to close on a lower high and close to reversing flow down. No bias can go either way. It appears the positive close may just be rally in down trend.

AUD - D closed negative but could not cause 8lwma cross, 4hr the opposite closing positive but could not cause cross. No bias can go either way.

Monday, August 12, 2013

12 Aug 2013

EUR - D closed negative reacting to the June high, RSI showing divergence and crossed below its signal line. The 1hr did not want to go higher for 4 hrs then gave a 3 bar reversal negative close going into the US open. We have W pivot at 1.3323 and a support/resistance level at 1.3300. Only time will tell if this is dip in uptrend or start of move down. No bias can go either way.

GU - D closed an inside candle rejecting the identified resistance level. 4hr RSI crossed lower after divergence. We pulled back to an area 1.5490 that gave support in June-Aug 2012. I suspect down but no bias can go either way.

EJ - D a lower high negative close. 4hr on lower high lower low but showing positive divergence. For now we have stopped at the 10 July low with our next identified support level about 100 pips lower. Bias down.

EURAUD - D closed an over sized candle at the 12 July high. Often these over sized candles do not follow through immediately. A bounce up would not be unexpected but bias down.

AUD - D closed positive. 4hr shows a series of 'weak' negative closes that could not close below the 8lwma. After several days straight up a pause/retrace is due but bias remains up.

GU - D closed an inside candle rejecting the identified resistance level. 4hr RSI crossed lower after divergence. We pulled back to an area 1.5490 that gave support in June-Aug 2012. I suspect down but no bias can go either way.

EJ - D a lower high negative close. 4hr on lower high lower low but showing positive divergence. For now we have stopped at the 10 July low with our next identified support level about 100 pips lower. Bias down.

EURAUD - D closed an over sized candle at the 12 July high. Often these over sized candles do not follow through immediately. A bounce up would not be unexpected but bias down.

AUD - D closed positive. 4hr shows a series of 'weak' negative closes that could not close below the 8lwma. After several days straight up a pause/retrace is due but bias remains up.

Subscribe to:

Posts (Atom)