Whilst there can be trades on such days I'll watch charts a little longer but will probably take the day off and do some admin.

So it looks like we'll start trading tomorrow.

All the world's a stage and we are merely players. Discipline is the bridge between goals and accomplishment.

Monday, May 31, 2010

Key levels, will they hold or fail

There are numerous key levels on any chart. For example previous support and resistance levels, pivots, round numbers, fib's. The more important the level the bigger the reaction should be. There are some very good traders out there that can identify and trade these key levels.

I look to exit trades at key levels and then look for a reaction. As an example if a certain price caused a 200 pip move previously and comes back hits and moves 40, hits again and moves 20 (hopefully you've been in all the trades in direction of trend). Those smaller bounces away from the key level are usually pretty good indications that the key level will fail.

Nothing works 100% (as previously mentioned and price will do what it wants) but apart from the hope that we will have been in the moves (trading higher lows and lower highs) to the key levels, we look at the size of bounces. If the bounces are getting smaller we'll look for the right candles to see if that key level will fail.

Higher lows/lower highs from these levels provide opportunities to enter the market at extremes.

I look to exit trades at key levels and then look for a reaction. As an example if a certain price caused a 200 pip move previously and comes back hits and moves 40, hits again and moves 20 (hopefully you've been in all the trades in direction of trend). Those smaller bounces away from the key level are usually pretty good indications that the key level will fail.

Nothing works 100% (as previously mentioned and price will do what it wants) but apart from the hope that we will have been in the moves (trading higher lows and lower highs) to the key levels, we look at the size of bounces. If the bounces are getting smaller we'll look for the right candles to see if that key level will fail.

Higher lows/lower highs from these levels provide opportunities to enter the market at extremes.

Sunday, May 30, 2010

Searching for a trading system

If you are searching for people to trade for you click on Trading Systems under useful links.

Personally I do not use this. The services I use/have used are the cashbackforex rebates and the forexexmentor. Both links above.

Personally I do not use this. The services I use/have used are the cashbackforex rebates and the forexexmentor. Both links above.

My basic trades, higher lows and lower highs

I'll explain my methods here but go to forexfactory to see these explained with charts, see the "useful links". These are the regular trades I look to enter.

A good trader said to me that the first retracement is the best trade, ie the first higher low/lower high in a move. These retracements provide good opportunities to enter into a move with a relatively small stop loss.

There are 3 trades to consider:

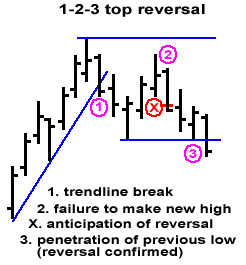

1)Higher lows and lower highs on 5 min charts can be taken at extremes (also known as 1 2 3 tops/bottoms). I would want to see the reversal at a key level ie previous support/resistance area, pivot, round number etc etc.

2)What I'll call 100% system trades that will follow the 1hr with entry from 5 min higher lows and lower highs. I do not want to see an obvious contra indication from 15 min, e.g. I would not want to be selling a 5 min lh immediately after a high vol hammer on 15 min. I would like to be selling a 5 min lh after an engulfing negative close candle/shooting star with little/no lower wick on 15 min.

3)A 2b reversal trade which is a variation of 123 top/bottom and is also an indication of a test and failure. We only look at 2b trades in and around London open, at a key level with a move back into the trend on D.

"In an uptrend, if prices penetrate the previous high but fail to carry through and immediately drop below the previous high, the trend is apt to reverse. The converse is true for downtrends." [Vic Sperandeo in "Trader Vic: Methods of a Wall Street Master"]

General

Some knowledge of candlestick analysis is required as you want to be trading the right candles.

Some of the key items are: consider key levels for turns (eg round numbers, D and W pivots, some fibs), follow the 1hr, are we above or below the 1hr 8 lwma, 5 min hl/lh's. A cross of an 8 lwma on the 5 min chart gives an easy visual clue of a higher low or lower high in most cases. Once set up on 5 min price should move a pip or so beyond the high low of the set up candle to confirm the trade.

NB Watching and trading the right candles is always important. London open typically has a head fake, this turn can happen quickly which is why we look for a decent 15 min candle at least. The pre US session can take a couple of hours to turn and there we need more than a 15 min candle, a good 1hr set up minimum. Avoid weak pre/early US open counter trend candles on 1hr, they are often fake out moves. The 1hr higher low, lower high intra day that reverts to trend is a much better set up.

Always be looking to assess the trend from D, then 1hr flows i.e. 1hr higher lows and lower highs. For example you assess D as downtrend but last 1hr flow is higher high, higher low. Then you have a counter trend rally and might need to wait for 1hr to revert to lower high before selling again.

Stops: Around 15 pips 1.5% of capital. Typically to the last 5 min swing high/low.

Exits: Depends on where you entered in a run. I look to target areas where bounces or turns are likely to occur.

COT possibilities in the week ahead

3rd party report.

There has been SIGNIFICANT buying and closing of short sales this week in JPY. If

its strong next week trade it against the weakest pair at the time.

The EUR has been sold for a long time but traders closed out some of their long positions and this the % short in EUR has increased nicely. If EUR is weak next week consider selling it against the JPY above if JPY is strong at the time.

Looks like I might have to change focus from gu to ej a little in the coming week.

There has been SIGNIFICANT buying and closing of short sales this week in JPY. If

its strong next week trade it against the weakest pair at the time.

The EUR has been sold for a long time but traders closed out some of their long positions and this the % short in EUR has increased nicely. If EUR is weak next week consider selling it against the JPY above if JPY is strong at the time.

Looks like I might have to change focus from gu to ej a little in the coming week.

Saturday, May 29, 2010

Why trade forex

There are some tremendous advantages:

1)The barriers to entry are low, basically means you can start with a few hundred dollars to fund an account and buy a course.

2)No staff, no offices, no stock (to buy, hold, insure, sell) and very little equipment. You need a computer and an internet connection.

3)The bank will lend you money ie you can leverage your account. Ever tried borrowing money from a bank after a financial crisis? You have to be very, very strong financially or the answer is no.

4)Its portable, you can take this anywhere in the world.

5)It's flexible, choose your hours and no commute to work. You're the boss.

That however means there are some dis-advantages:

1)Low barriers to entry ie it didn't cost much to get going may mean you don't put in the effort necessary to make it work.

2)You may want (need?) to make it all happen tomorrow or see this as a quick fix for other (financial?) problems.

3)Think it looks so easy, jump in all over the place and lose money. Ever wondered why top sportsmen have coach's and mentor's. The mental side of trading is crucial.

Get this business right and potentially you have a great opportunity, if you can get that idea right in your mind at the start and put in the effort you'll have an advantage. It takes work (well at least it did for me).

1)The barriers to entry are low, basically means you can start with a few hundred dollars to fund an account and buy a course.

2)No staff, no offices, no stock (to buy, hold, insure, sell) and very little equipment. You need a computer and an internet connection.

3)The bank will lend you money ie you can leverage your account. Ever tried borrowing money from a bank after a financial crisis? You have to be very, very strong financially or the answer is no.

4)Its portable, you can take this anywhere in the world.

5)It's flexible, choose your hours and no commute to work. You're the boss.

That however means there are some dis-advantages:

1)Low barriers to entry ie it didn't cost much to get going may mean you don't put in the effort necessary to make it work.

2)You may want (need?) to make it all happen tomorrow or see this as a quick fix for other (financial?) problems.

3)Think it looks so easy, jump in all over the place and lose money. Ever wondered why top sportsmen have coach's and mentor's. The mental side of trading is crucial.

Get this business right and potentially you have a great opportunity, if you can get that idea right in your mind at the start and put in the effort you'll have an advantage. It takes work (well at least it did for me).

Discipline ............

Discipline is the bridge between goals and accomplishments.

If you can get this simple concept right you'll probably have a great trading career. The only trick is it's a massive all embracing concept.

Discipline to:

1)Take the time and effort to check your trading plan works (in up/down/ranging markets).

2)Execute flawlessly. This doesn't mean every trade is a winner (they won't be) but it means to trade when you see your rules play out.

3)Not chase a move simply because you are scared you'll miss out, there are more trades coming.

4)Know the difference between a price move and a trade. A trade is something that complies with your rules. A price move is a random jump in the market that you couldn't have anticipated.

So plan your trades, trade your plan and avoid the wrong trades.

If you can get this simple concept right you'll probably have a great trading career. The only trick is it's a massive all embracing concept.

Discipline to:

1)Take the time and effort to check your trading plan works (in up/down/ranging markets).

2)Execute flawlessly. This doesn't mean every trade is a winner (they won't be) but it means to trade when you see your rules play out.

3)Not chase a move simply because you are scared you'll miss out, there are more trades coming.

4)Know the difference between a price move and a trade. A trade is something that complies with your rules. A price move is a random jump in the market that you couldn't have anticipated.

So plan your trades, trade your plan and avoid the wrong trades.

Some gbpusd thoughts

Nothing works 100% of the time, some things happen regularly enough to take note of. These are some of those thoughts on trading gbpusd.

1)GU likes 50% fib's

2)GU likes the 25/75 psych levels

3)The first 15 minutes in Frankfurt trading (European open, Frankies hour or FH) is often a fake out and we rarely trade then.

4)A typical range for FH is 40 pips, upper range 60.

5)Bank your pips in FH.

6)We do not trade a 2nd move in same direction in FH, especially if the range is close to complete and we 30 mins in that hour.

7)Frankie often has a half hour reversal. Some traders I like think the FH move is often just a fake out move for the London session. Some call it the London open head fake.

8)Stop sweeps. If price is falling and goes below 15, it can often fall below the even number to 85. The opposite is also true if price is rising through 85 area it can often go above the round number to 15.

9)We like to trade London session until price has moved around 125 pips.

10)UK News events generally move GU in 1 direction (US news events can be much more volatile).

1)GU likes 50% fib's

2)GU likes the 25/75 psych levels

3)The first 15 minutes in Frankfurt trading (European open, Frankies hour or FH) is often a fake out and we rarely trade then.

4)A typical range for FH is 40 pips, upper range 60.

5)Bank your pips in FH.

6)We do not trade a 2nd move in same direction in FH, especially if the range is close to complete and we 30 mins in that hour.

7)Frankie often has a half hour reversal. Some traders I like think the FH move is often just a fake out move for the London session. Some call it the London open head fake.

8)Stop sweeps. If price is falling and goes below 15, it can often fall below the even number to 85. The opposite is also true if price is rising through 85 area it can often go above the round number to 15.

9)We like to trade London session until price has moved around 125 pips.

10)UK News events generally move GU in 1 direction (US news events can be much more volatile).

Friday, May 28, 2010

Getting started

Where to start, that's what you'll be thinking. All I can do is tell you what I did.

First of all you can go to the "get forex rebates" link above and choose a company you are happy with and download their demo platform. Literally play around to get comfortable with the platform and how things work. You can fund a live account and still demo trade. Don't be tempted to trade live until you are comfortable with your methods. Money management is key, I don't risk more than 2% on any one trade. Often only 1-1.5%.

There's lots of information available from forexfactory, babypips and the free video course links above. Putting it all together into something that works for you is the trick. It can take some time to figure out.

I started with a course from Peter Bain's Forexmentor (discount available from the get forex rebates link above). I believe him to be an honourable person giving a good course.

At the time Seth Gregory also worked in association with Peter. Seth has now branched out onto his own and the link to his site is also above. I was always extremely impressed with Seth, his methods, attitude and trading skills. I'd recommend him based on what I experienced. He has some free information and other services. If you want to get going trading live whilst you learn you need to plug into a proven system. Seth's forex active trader is an option to consider. He has a $19.99 14 day trial which would give you access to trades and if you are happy with how things are going ie making money you can consider extending month by month whilst you learn to trade.

Once you are comfortable that you have the knowledge and experience with your system, most important the temperament to trade, you can of course go live and hopefully one day join the ranks of full time traders. That's the goal, just don't put too much pressure on yourself to get there.

First of all you can go to the "get forex rebates" link above and choose a company you are happy with and download their demo platform. Literally play around to get comfortable with the platform and how things work. You can fund a live account and still demo trade. Don't be tempted to trade live until you are comfortable with your methods. Money management is key, I don't risk more than 2% on any one trade. Often only 1-1.5%.

There's lots of information available from forexfactory, babypips and the free video course links above. Putting it all together into something that works for you is the trick. It can take some time to figure out.

I started with a course from Peter Bain's Forexmentor (discount available from the get forex rebates link above). I believe him to be an honourable person giving a good course.

At the time Seth Gregory also worked in association with Peter. Seth has now branched out onto his own and the link to his site is also above. I was always extremely impressed with Seth, his methods, attitude and trading skills. I'd recommend him based on what I experienced. He has some free information and other services. If you want to get going trading live whilst you learn you need to plug into a proven system. Seth's forex active trader is an option to consider. He has a $19.99 14 day trial which would give you access to trades and if you are happy with how things are going ie making money you can consider extending month by month whilst you learn to trade.

Once you are comfortable that you have the knowledge and experience with your system, most important the temperament to trade, you can of course go live and hopefully one day join the ranks of full time traders. That's the goal, just don't put too much pressure on yourself to get there.

Tuesday, May 25, 2010

Basic trading strategy

My basic strategy is to follow the 1hr chart. Looking for the flow, that is higher highs higher lows in uptrend, lower highs lower lows in downtrend. Then good candles (there are 5 or 6 that work nicely), once 1hr direction is set I'm then looking at taking entry off 5 min higher lows and lower highs.

What's your personality

The type of person you are, what time you have available to you will determine how you trade. I remember someone saying to me that he had 2 systems, one worked very well and one he just couldn't get right. My advice obviously was to stick with the one that worked for him.

Some people hate looking at anything below a 4 hr chart, some work on 5 mins. I prefer to watch a trade, I'm impatient sitting on the sidelines. So I developed a system that works for me under those circumstances.

Some people hate looking at anything below a 4 hr chart, some work on 5 mins. I prefer to watch a trade, I'm impatient sitting on the sidelines. So I developed a system that works for me under those circumstances.

More general thoughts

1. Trade what you see not what you think. Don't get locked into an opinion about direction. You could be wrong just as easily as right.

2. Build a strong self image.

3. Review your trades and your goals.

4. Mistakes are valuable lessons, perhaps more important than winning trades. Make sure you learn from and don't repeat mistakes.

5. Have you looked at how your system stacks up in a trending (up and down) as well as a ranging market?

6. Learn to relax. Feel good about yourself.

7. Think clearly, got major problems in your life? If you do it's probably not a good time to trade.

8. Picture yourself as a successful trader.

9. You do not have to have trades generating hundreds of pips to make a great income.

10. Don't carry on making the same mistakes, if your system is not working stop trading real money and go back to the drawing board. Making the same mistakes is going to give you the same results and it isn't pretty.

2. Build a strong self image.

3. Review your trades and your goals.

4. Mistakes are valuable lessons, perhaps more important than winning trades. Make sure you learn from and don't repeat mistakes.

5. Have you looked at how your system stacks up in a trending (up and down) as well as a ranging market?

6. Learn to relax. Feel good about yourself.

7. Think clearly, got major problems in your life? If you do it's probably not a good time to trade.

8. Picture yourself as a successful trader.

9. You do not have to have trades generating hundreds of pips to make a great income.

10. Don't carry on making the same mistakes, if your system is not working stop trading real money and go back to the drawing board. Making the same mistakes is going to give you the same results and it isn't pretty.

More general ideas and guidelines

1. A none system trade than wins is probably the worst thing you can have happen to you. You'll either dilute your system or trade everything in sight thinking you can. Act in your own best interests.

2. Trading rules, get them, follow them. Trading rules should cover entry, stops and exit strategy. Its your trade take 100% responsibility. Rules can also cover hours you trade, stopping after so many losses, whatever is right for you.

3. Trading because you are afraid of missing a move is not acting in your own best interest.

4. If its going up buy, if its going down sell.

5. Flawless execution. You don't need to buy the absolute low or sell the absolute high to make money. Flawless execution means acting on an opportunity in terms of your rules the moment that you see it. Act without hesitation. Follow your rules flawlessly.

6. Use stops always.

7. Lock in profits, trail stops in a manner appropriate to your system.

8. In this business protecting yourself and acting in your own best interests is so much more important than taking a chance. Its not even close. Remember you are trading, not gambling.

9. Keep yourself out of bad losing trades, the quality winning trades per your system will come.

10. Bank profits, what's the market offering and what are your goals? Let winners run.

2. Trading rules, get them, follow them. Trading rules should cover entry, stops and exit strategy. Its your trade take 100% responsibility. Rules can also cover hours you trade, stopping after so many losses, whatever is right for you.

3. Trading because you are afraid of missing a move is not acting in your own best interest.

4. If its going up buy, if its going down sell.

5. Flawless execution. You don't need to buy the absolute low or sell the absolute high to make money. Flawless execution means acting on an opportunity in terms of your rules the moment that you see it. Act without hesitation. Follow your rules flawlessly.

6. Use stops always.

7. Lock in profits, trail stops in a manner appropriate to your system.

8. In this business protecting yourself and acting in your own best interests is so much more important than taking a chance. Its not even close. Remember you are trading, not gambling.

9. Keep yourself out of bad losing trades, the quality winning trades per your system will come.

10. Bank profits, what's the market offering and what are your goals? Let winners run.

More general ideas and guidelines

1. Setting goals. They must be realistic, attainable and measurable. Visualise yourself reaching these goals.

2. Always use stops, appropriate to your system.

3. Time has no bearing on money. You could earn 5% in an hour more than you get from a bank account in a year. That has no bearing on whether the market is going to carry on in the same direction.

4. Nobody went broke banking profits.

5. Review each session, what did the market give, what could you reasonably get.

6. If you are consistently falling considerably short on whats reasonably available review your entry and exit strategy.

7. Demo trade successfully before you trade with real money. The market will be there tomorrow.

8. Go for experience before you go for the money, in trading and in life in general.

9. Don't stay married to a trade if everything suggests get out. Review losses, what, why, where and when are always good questions to ask. Did you trade your plan.

10. Plan your trade, stick to your system.

2. Always use stops, appropriate to your system.

3. Time has no bearing on money. You could earn 5% in an hour more than you get from a bank account in a year. That has no bearing on whether the market is going to carry on in the same direction.

4. Nobody went broke banking profits.

5. Review each session, what did the market give, what could you reasonably get.

6. If you are consistently falling considerably short on whats reasonably available review your entry and exit strategy.

7. Demo trade successfully before you trade with real money. The market will be there tomorrow.

8. Go for experience before you go for the money, in trading and in life in general.

9. Don't stay married to a trade if everything suggests get out. Review losses, what, why, where and when are always good questions to ask. Did you trade your plan.

10. Plan your trade, stick to your system.

Some general ideas and guidelines

1. Poor self discipline is the quickest way to lose money. A good trader with a poor plan will outperform a bad trader with a good plan.

2. Discipline is the bridge between goals and accomplishment.

3. You are not gambling, you are trading, this is a business treat it like one.

4. Your job is to take calculated risk. Calculated is the key word, what does your research tell you your system will do?

5. Forgive yourself for making a mistake and move on. Don't repeat the same mistakes.

6. Reach a stage where you can control your emotions. You can do that by ensuring your plan works and if a trade does not go your way that's just one of those things. You will not always have winning trades.

7. Set achievable, measurable goals. Percentage winning trades and numbers of pips. Average wins and average losses will influence these numbers. If an average win is 150 and an average loss 15 you need far fewer winning trades than if your average win is 30 and your average loss 15.

8. Do not give yourself undue pressure trying to trade on a full time basis too early in the game. Act in your own best interests.

9. You cannot control the market, you can only control yourself and react to what the market gives.

10. The market will do what it wants to, not what you want.

2. Discipline is the bridge between goals and accomplishment.

3. You are not gambling, you are trading, this is a business treat it like one.

4. Your job is to take calculated risk. Calculated is the key word, what does your research tell you your system will do?

5. Forgive yourself for making a mistake and move on. Don't repeat the same mistakes.

6. Reach a stage where you can control your emotions. You can do that by ensuring your plan works and if a trade does not go your way that's just one of those things. You will not always have winning trades.

7. Set achievable, measurable goals. Percentage winning trades and numbers of pips. Average wins and average losses will influence these numbers. If an average win is 150 and an average loss 15 you need far fewer winning trades than if your average win is 30 and your average loss 15.

8. Do not give yourself undue pressure trying to trade on a full time basis too early in the game. Act in your own best interests.

9. You cannot control the market, you can only control yourself and react to what the market gives.

10. The market will do what it wants to, not what you want.

Subscribe to:

Posts (Atom)