All the world's a stage and we are merely players. Discipline is the bridge between goals and accomplishment.

Friday, December 3, 2010

Todays trades

Price supported at Y's US late session highs around 5610. 15 min doji, 5 min hl with little/no upper wicks. Price struggled at Wed's high 5648, gave some chance but with UK news coming and our internet connection playing up happy to exit with +20.

Friday, November 26, 2010

Todays trades

Top chart.

1hr positive close doji, reject of 85 level (15/85 trade down). 15 min positive close. 5 min hl, little no upper wick on entry candle.

Counter trend so out +20. Obviously a realistic target is 5750 but what the heck.

Bottom chart.

1hr positive close but large upper wick around Y's low. 15 min shooting star. 5 min lh little/no lower wick. Mrs V's its Freaky Fri I'm not playing with RN +20 bank indi went off. So out +20.

We are also going out in a little bit so 2 x +20 and we are pretty happy. No doubt at least we are going to 5685 and lower from there TWT.

1hr positive close doji, reject of 85 level (15/85 trade down). 15 min positive close. 5 min hl, little no upper wick on entry candle.

Counter trend so out +20. Obviously a realistic target is 5750 but what the heck.

Bottom chart.

1hr positive close but large upper wick around Y's low. 15 min shooting star. 5 min lh little/no lower wick. Mrs V's its Freaky Fri I'm not playing with RN +20 bank indi went off. So out +20.

We are also going out in a little bit so 2 x +20 and we are pretty happy. No doubt at least we are going to 5685 and lower from there TWT.

Wednesday, November 24, 2010

EJ lower high trade

Tuesday, November 23, 2010

Eur lower high trade

Tuesday, November 16, 2010

Todays trades

The trading pre UK news 9.30 gmt did not offer good set ups for us. After the news the move up quickly struggled. A classic 15 min shooting star was followed up by a perfect 5 min lh. Price moved below the multi time frame ma (set to equal the 1 hr 8 lwma). We then had 2 perfect lh's.

As you'll see when you wait for the right set ups (in this case following the 1 hr and 15 min) these 5 min lh's had little/no lower wicks suggesting likely falls in direction of move down.

Price halted at the low of 12 Nov.

As you'll see when you wait for the right set ups (in this case following the 1 hr and 15 min) these 5 min lh's had little/no lower wicks suggesting likely falls in direction of move down.

Price halted at the low of 12 Nov.

Friday, November 12, 2010

Ticking over

GU 15 min, showing that chart here but entry was from the next 1 min lh that followed the 15 min close.

Why this 15 min set up candle and not the others, well this one closed on the low of prev support with little/no lower wick. The 1 min lh that followed 15 min close, price stayed below the 50 level (another one of our favoured set ups) to confirm the sell even though at that stage the low of previous support hadn't been broken.

My target was originally the 85 level once 6015 area broken (the 15/85 trade) but when RN was giving some resistance Mrs V said out so we did.

Why this 15 min set up candle and not the others, well this one closed on the low of prev support with little/no lower wick. The 1 min lh that followed 15 min close, price stayed below the 50 level (another one of our favoured set ups) to confirm the sell even though at that stage the low of previous support hadn't been broken.

My target was originally the 85 level once 6015 area broken (the 15/85 trade) but when RN was giving some resistance Mrs V said out so we did.

Monday, October 11, 2010

September a struggle

Haven't posted for a while. I had a tough time in September finishing around 5.5% for the month. I've decided to calm down get some trades under the belt again before I post daily here.

100% system trade, 1hr down, 15 min shooting star, 5 min lh, entry candle little/no lower wick. Target the 25 psych level/38% fib retrace of Fri's range which was achieved.

100% system trade, 1hr down, 15 min shooting star, 5 min lh, entry candle little/no lower wick. Target the 25 psych level/38% fib retrace of Fri's range which was achieved.

Tuesday, September 7, 2010

Todays returns

Today 1 trade, 1 winner.

Month to date 2 winners 0 losers ROI 2.2%.

See my trades at forexfactory under useful links where trades and charts are posted.

We missed the 2b sell below 5425 level on the 7RB chart. The multi bottom earlier 5355 with CII divergence buy was a little early for us. Nice set up though.

We took this lh and just waited for DO 5392 to clear.

Exit +24 when 5360 held a few times.

Month to date 2 winners 0 losers ROI 2.2%.

See my trades at forexfactory under useful links where trades and charts are posted.

We missed the 2b sell below 5425 level on the 7RB chart. The multi bottom earlier 5355 with CII divergence buy was a little early for us. Nice set up though.

We took this lh and just waited for DO 5392 to clear.

Exit +24 when 5360 held a few times.

Monday, September 6, 2010

Todays returns

Today 1 trade, 1 winner.

Month to date 1 winner 0 losers ROI 1%.

See my trades at forexfactory under useful links where trades and charts are posted.

CII divergence on 1hr, 30 min, 15 min and 5 min. Dble top, 15 min doji. Entry taken when 7RB showed div and neg close.

Target run down to 50 level. I had to pop out and missed the perfect system lh trades that followed.

Month to date 1 winner 0 losers ROI 1%.

See my trades at forexfactory under useful links where trades and charts are posted.

CII divergence on 1hr, 30 min, 15 min and 5 min. Dble top, 15 min doji. Entry taken when 7RB showed div and neg close.

Target run down to 50 level. I had to pop out and missed the perfect system lh trades that followed.

Thursday, August 26, 2010

Todays returns

Today 3 trades, 1 winner 1 loser.

Month to date 24 winners 10 losers ROI 28.6%.

See my trades at forexfactory under useful links where trades and charts are posted.

We sold the 2b set up right at the top but as is usually the case got out at BE when we hit +8/9 a couple of times and it seemed like it just didn't want to go.

Entered a little later again. This was against pos close 15 min candles but 15 min had upper wick and the vol in move up on 5 min clearly falling away. The res area is clearly shown on 5 min at the 5565 W pivot. The 7RB entry was there but showing the 5 min as for us it just seemed to show the res area clearer. Exit at psych level +23.

We then had a later re-entry 7RB lh below psych level exited for small loss when it never followed through.

Month to date 24 winners 10 losers ROI 28.6%.

See my trades at forexfactory under useful links where trades and charts are posted.

We sold the 2b set up right at the top but as is usually the case got out at BE when we hit +8/9 a couple of times and it seemed like it just didn't want to go.

Entered a little later again. This was against pos close 15 min candles but 15 min had upper wick and the vol in move up on 5 min clearly falling away. The res area is clearly shown on 5 min at the 5565 W pivot. The 7RB entry was there but showing the 5 min as for us it just seemed to show the res area clearer. Exit at psych level +23.

We then had a later re-entry 7RB lh below psych level exited for small loss when it never followed through.

Wednesday, August 25, 2010

Todays returns

Today 2 trades, 1 winner 1 loser.

Month to date 23 winners 9 losers ROI 27.8%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 23 winners 9 losers ROI 27.8%.

See my trades at forexfactory under useful links where trades and charts are posted.

Tuesday, August 24, 2010

More on Last post - Bounces from key levels

See 31 May blog post Key levels will they hold or fail.

There are numerous key levels on any chart. For example previous support and resistance levels, pivots, round numbers, fib's. The more important the level the bigger the reaction should be. There are some very good traders out there that can identify and trade these key levels.

I look to exit trades at key levels and then look for a reaction. As an example if a certain price caused a 200 pip move previously and comes back hits and moves 40, hits again and moves 20 (hopefully you've been in all the trades in direction of trend). Those smaller bounces away from the key level are usually pretty good indications that the key level will fail.

Nothing works 100% (as previously mentioned and price will do what it wants) but apart from the hope that we will have been in the moves (trading higher lows and lower highs) to the key levels, we look at the size of bounces. If the bounces are getting smaller we'll look for the right candles to see if that key level will fail.

There are numerous key levels on any chart. For example previous support and resistance levels, pivots, round numbers, fib's. The more important the level the bigger the reaction should be. There are some very good traders out there that can identify and trade these key levels.

I look to exit trades at key levels and then look for a reaction. As an example if a certain price caused a 200 pip move previously and comes back hits and moves 40, hits again and moves 20 (hopefully you've been in all the trades in direction of trend). Those smaller bounces away from the key level are usually pretty good indications that the key level will fail.

Nothing works 100% (as previously mentioned and price will do what it wants) but apart from the hope that we will have been in the moves (trading higher lows and lower highs) to the key levels, we look at the size of bounces. If the bounces are getting smaller we'll look for the right candles to see if that key level will fail.

Bounces from key levels

Regulars at my forexfactory thread have seen me talk of these set ups many, many times.

I wasn't in front of computer for this one.

EJ almost gets to 106, and bounces some 70 pips. Then it falls to 25 level and the bounces get smaller and smaller. Smaller bounces from a level is a high prob signal that the level will fail.

When the right set up occurs, 1hr down, 15 min down, 5 min lh with little/low lower wick on set up candle there's a good chance its going to break through.

If you got in earlier bounces and got out keep going if bounces are smaller.

I wasn't in front of computer for this one.

EJ almost gets to 106, and bounces some 70 pips. Then it falls to 25 level and the bounces get smaller and smaller. Smaller bounces from a level is a high prob signal that the level will fail.

When the right set up occurs, 1hr down, 15 min down, 5 min lh with little/low lower wick on set up candle there's a good chance its going to break through.

If you got in earlier bounces and got out keep going if bounces are smaller.

Fxpro Info

GBP/USD

Another bear signal emerged Tuesday following the break into fresh one-month lows below 1.5465, extending the short-term downtrend towards 1.5415 and congested daily moving average support at 1.5350. However, there is scope for a deeper setback towards 1.5320, and the more significant pivotal support level at 1.5230. Only a break above 1.5503 would provide temporary respite, but corrective strength should be limited to resistance at 1.5540.

Another bear signal emerged Tuesday following the break into fresh one-month lows below 1.5465, extending the short-term downtrend towards 1.5415 and congested daily moving average support at 1.5350. However, there is scope for a deeper setback towards 1.5320, and the more significant pivotal support level at 1.5230. Only a break above 1.5503 would provide temporary respite, but corrective strength should be limited to resistance at 1.5540.

Fxpro Info

We could be watching Japan build a trap for yen bulls. With concern over the global recovery still rising and with global appetite for risk still falling, the yen is likely to remain in demand as a safe haven. This isn't good news for Japanese exporters, who have watched a decline in the dollar down to nearly Y85 erode their profits in the last few months. Pressure on the Japanese authorities to do something about the yen's strength is only likely to grow later this week as new data from Japan, including unemployment, consumer prices and household spending, will reinforce forecasts for continued slow growth and more deflation. Also on Tuesday, the Nikkei Index fell under 9000 for the first time since May 2009 because of exasperation over the lack of policy response. So far, though, there has been little concrete sign of action by either the government or the Bank of Japan and yen bulls have been getting bolder. Direct market intervention by the Bank of Japan has been largely ruled out, given the accusations Tokyo would face from the U.S. of currency manipulation. This is certainly something the Japanese authorities would want to avoid ahead of the next meeting of finance ministers from the Group of Seven nations early next month.

EJ Trade example

GU Trade example

5 min chart, volume is falling off on the move up to 25 psych level. In the big picture we're still on a lh, however we are running above the last 5 min lh with a few pips. Frankie's half hour reversal time.*

We took the trade reasons being: FH reversal, low vol move up against the trend, psych level break failed, supp/res level obvious, a 2b possible set up on the last high 8 candles earlier (5 min chart). Entry from 7RB chart.

Exit when break below RN hesitated and my auto +20 bank indi (Mrs V) was going crazy, +23.

*Half way through the Franfurt open initial hours trading can often have a direction reversal.

We took the trade reasons being: FH reversal, low vol move up against the trend, psych level break failed, supp/res level obvious, a 2b possible set up on the last high 8 candles earlier (5 min chart). Entry from 7RB chart.

Exit when break below RN hesitated and my auto +20 bank indi (Mrs V) was going crazy, +23.

*Half way through the Franfurt open initial hours trading can often have a direction reversal.

Todays returns

No trades taken yesterday.

Today 3 trades, 2 winners 1 loser.

Month to date 22 winners 8 losers ROI 27.8%.

See my trades at forexfactory under useful links where trades and charts are posted.

Today 3 trades, 2 winners 1 loser.

Month to date 22 winners 8 losers ROI 27.8%.

See my trades at forexfactory under useful links where trades and charts are posted.

Reply

Hi Indosoul

I have replied to your comment.

Don't forget to follow the link and consider getting rebates on your trading.

I have replied to your comment.

Don't forget to follow the link and consider getting rebates on your trading.

Friday, August 20, 2010

Indicators

I don't use much in the way of indicators. A friend has referred me to the CII indicator which I am looking at using only for divergence reasons in particular for the 2b variation.

Todays returns

Wednesday, August 18, 2010

Initial thoughts trading 7RB

Both GU and EJ like the 00, 25, 50, 75 psych levels. Once a trend is established (for now we'll describe that as a break of most recent range) where nice waves have formed on 7RB charts over 3/4 candles at these psych levels nice trades can result. This is todays GU price action before and after the news release.

Range Bars

I have been looking at 7 pip constant range bars in tandem with 5 min charts for entries. They do appear to offer some good opportunities when 1hr and 15 min charts have set direction. Some 5 min candles become too large to safely take a trade with the small stops we use. They are worth investigating.

Todays returns

No trades today being MPC minutes release, in hindsight after the news there were 2 solid higher lows on GU. Yesterday 1 trade just above BE.

On 16th 5 trades, 3 winners 1 losers.

Month to date 16 winners 5 loser ROI 21.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

On 16th 5 trades, 3 winners 1 losers.

Month to date 16 winners 5 loser ROI 21.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Friday, August 13, 2010

Todays returns

Includes trades for yesterday.

9 trades today and yesterday, 5 winners 2 losers.

Month to date 13 winners 4 loser ROI 17.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

9 trades today and yesterday, 5 winners 2 losers.

Month to date 13 winners 4 loser ROI 17.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Wednesday, August 11, 2010

Todays returns

4 trades today, 2 winners 1 loser.

Month to date 8 winners 2 loser ROI 10%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 8 winners 2 loser ROI 10%.

See my trades at forexfactory under useful links where trades and charts are posted.

Monday, August 9, 2010

Todays returns

2 trades today, 1 winner.

Month to date 6 winners 1 loser ROI 8.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 6 winners 1 loser ROI 8.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Thursday, August 5, 2010

Todays returns

3 trades today, 1 winner and 1 loser.

Month to date 5 winners 1 loser ROI 7.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 5 winners 1 loser ROI 7.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Fxpro Info

EUR/USD

The push below 1.3183 extends the corrective setback off Tuesday's high at 1.3262, and is looking to test the range floor at 1.3105. However, only a break below there would upgrade the setback and expose the 1.3056 area. Regaining ground above 1.3183 would lift the tone and re-open the 1.3241 lower high, which protects 1.3262. The significant 200-day moving average lies in this area, and a fresh wave of bull pressure is required to force a break through 1.3262, opening 1.3365.

GBP/USD

Resistance at Tuesday's 1.5966 high held Wednesday to prompt a corrective setback to test support at 1.5863. Bear pressure is building here to threaten a deeper setback towards 1.5810, although the 1.5750 area will look to limit downside scope. A break above 1.5940 is required to re-open the 1.5966 high, which stands in front of the psychologically-important 1.6000 level.

The push below 1.3183 extends the corrective setback off Tuesday's high at 1.3262, and is looking to test the range floor at 1.3105. However, only a break below there would upgrade the setback and expose the 1.3056 area. Regaining ground above 1.3183 would lift the tone and re-open the 1.3241 lower high, which protects 1.3262. The significant 200-day moving average lies in this area, and a fresh wave of bull pressure is required to force a break through 1.3262, opening 1.3365.

GBP/USD

Resistance at Tuesday's 1.5966 high held Wednesday to prompt a corrective setback to test support at 1.5863. Bear pressure is building here to threaten a deeper setback towards 1.5810, although the 1.5750 area will look to limit downside scope. A break above 1.5940 is required to re-open the 1.5966 high, which stands in front of the psychologically-important 1.6000 level.

Wednesday, August 4, 2010

Todays returns

1 trade today, 1 winner.

Month to date 4 winners 0 losers ROI 5.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 4 winners 0 losers ROI 5.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Tuesday, August 3, 2010

Todays returns

Includes late post for yesterday.

3 trades today, 3 winners.

Month to date 3 winners 0 losers ROI 3.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

3 trades today, 3 winners.

Month to date 3 winners 0 losers ROI 3.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Friday, July 30, 2010

Todays returns

2 trades today, 2 winners.

Month to date 15 winners 5 losers ROI 19%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 15 winners 5 losers ROI 19%.

See my trades at forexfactory under useful links where trades and charts are posted.

Todays returns

Late post for 29 July.

2 trades today, 2 losers.

Month to date 13 winners 5 losers ROI 15.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

2 trades today, 2 losers.

Month to date 13 winners 5 losers ROI 15.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Fxpro Info

EUR/USD

Thursday's strength completed a bull pennant and is within a whisker of testing key 1.3120/25 resistance area. This area incorporates the 38.2% retracement level of the 1.5145/1.1876 decline and the measured objective of an inverse head-and-shoulders base pattern, and only a fresh wave of bull pressure will manage to force a clean break above there, opening 1.3150 and 1.3200. Support lies at 1.3047, but only below the bull pennant termination low at 1.2969 would concern bulls.

GBP/USD

Maintains the dominant short-term uptrend having set a fresh five-month high at 1.5661 Thursday, and is approaching the key 1.5700 resistance area. A weakening in bull momentum can be seen, so only a fresh wave of bull pressure would force a clean break through 1.5700, opening 1.5814. Weakness should be limited to the 1.5510/25 support area, which is protected by 1.5548.

Thursday's strength completed a bull pennant and is within a whisker of testing key 1.3120/25 resistance area. This area incorporates the 38.2% retracement level of the 1.5145/1.1876 decline and the measured objective of an inverse head-and-shoulders base pattern, and only a fresh wave of bull pressure will manage to force a clean break above there, opening 1.3150 and 1.3200. Support lies at 1.3047, but only below the bull pennant termination low at 1.2969 would concern bulls.

GBP/USD

Maintains the dominant short-term uptrend having set a fresh five-month high at 1.5661 Thursday, and is approaching the key 1.5700 resistance area. A weakening in bull momentum can be seen, so only a fresh wave of bull pressure would force a clean break through 1.5700, opening 1.5814. Weakness should be limited to the 1.5510/25 support area, which is protected by 1.5548.

Tuesday, July 27, 2010

Todays returns

2 trades today, 2 winners.

Month to date 13 winners 3 losers ROI 18.3%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 13 winners 3 losers ROI 18.3%.

See my trades at forexfactory under useful links where trades and charts are posted.

Monday, July 26, 2010

Todays returns

3 trades today, 2 winners, 1 losing.

Month to date 11 winners 3 losers ROI 16.3%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 11 winners 3 losers ROI 16.3%.

See my trades at forexfactory under useful links where trades and charts are posted.

Friday, July 23, 2010

Todays returns

2 trades today, 1 winner, 1 losing. 2 trades yesterday, 2 winners.

Month to date 9 winners 2 losers ROI 13.8%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 9 winners 2 losers ROI 13.8%.

See my trades at forexfactory under useful links where trades and charts are posted.

Exit strategy

Mrs V has agreed to a slight TP change as we are missing out on way too many big moves.

7-9 am gmt exits will be taken at key levels due to the small ranges in Frankies hour that typically exist.

After 9 am gmt we will look for the FH/LO range to break (there is typically a head fake move in that time). Once that has happened we will look to bank 50-75% of trade at a key level, stop to BE. We will look to re-enter with full trade size hl/lh's in line with move. Again exiting 50/75% at next key target. Moving stop from original position along.

This alows scaling without risk exceeding 1.5%.

We will endeavour to trade through news events.

This may only be started after August holidays.

7-9 am gmt exits will be taken at key levels due to the small ranges in Frankies hour that typically exist.

After 9 am gmt we will look for the FH/LO range to break (there is typically a head fake move in that time). Once that has happened we will look to bank 50-75% of trade at a key level, stop to BE. We will look to re-enter with full trade size hl/lh's in line with move. Again exiting 50/75% at next key target. Moving stop from original position along.

This alows scaling without risk exceeding 1.5%.

We will endeavour to trade through news events.

This may only be started after August holidays.

Tuesday, July 20, 2010

Todays returns

2 trades today, 1 winner, 1 break even.

Month to date 6 winners 1 loser ROI 11.3%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 6 winners 1 loser ROI 11.3%.

See my trades at forexfactory under useful links where trades and charts are posted.

Fxpro Info

EUR/USD

Monday's recovery off 1.2871 will look to extend Tuesday to put last Friday's peak at 1.3008 under pressure. A break above there is favoured at this stage, opening 1.3055 and congested resistance at 1.3095, incorporating both a wave equality target and the May 10 lower high. Failure to break above 1.3008 would suggest more lateral consolidation is required prior to an upside break, prompting a drift back towards the 1.2871 low.

GBP/USD

Failure to keep former range highs at 1.5230 intact is an indication of GBP weakness, and while 1.5283 caps the upside, there is scope for renewed bear pressure on support at 1.5205. A break below there would unveil the downwave equality target at 1.5158, which lies close to the 61.8% retracement level of the 1.4949/1.5470 rally, at 1.5145. Above 1.5283 would lift the tone, but only regaining ground above the 1.5349 lower high would suggest a return to the 1.5470 is possible.

Monday's recovery off 1.2871 will look to extend Tuesday to put last Friday's peak at 1.3008 under pressure. A break above there is favoured at this stage, opening 1.3055 and congested resistance at 1.3095, incorporating both a wave equality target and the May 10 lower high. Failure to break above 1.3008 would suggest more lateral consolidation is required prior to an upside break, prompting a drift back towards the 1.2871 low.

GBP/USD

Failure to keep former range highs at 1.5230 intact is an indication of GBP weakness, and while 1.5283 caps the upside, there is scope for renewed bear pressure on support at 1.5205. A break below there would unveil the downwave equality target at 1.5158, which lies close to the 61.8% retracement level of the 1.4949/1.5470 rally, at 1.5145. Above 1.5283 would lift the tone, but only regaining ground above the 1.5349 lower high would suggest a return to the 1.5470 is possible.

Monday, July 19, 2010

Fxpro Info

EUR/USD

Consolidates off Friday's peak at 1.3008 to correct the bull wave off 1.2522, but support is likely to emerge above 1.2850 as the short-term uptrend remains decisively strong. The main threat is for a break above the 1.2955 lower high to open the 1.3008 high, creating room for further gains towards wave equality at 1.3095. The 1.2805 area provides the downside limit for corrective weakness.

GBP/USD

Friday's inside day tests key support at 1.5230, but this area is expected to survive during Monday's session and prompt a recovery back towards last week's bullish outside week high at 1.5470. A break above 1.5400 is required to lift the tone and open the 1.5445 lower high, which stands in the way of the 1.5470 peak. Only a sustained break below 1.5230 would concern bulls at this stage, exposing 1.5209 and 1.5191.

Consolidates off Friday's peak at 1.3008 to correct the bull wave off 1.2522, but support is likely to emerge above 1.2850 as the short-term uptrend remains decisively strong. The main threat is for a break above the 1.2955 lower high to open the 1.3008 high, creating room for further gains towards wave equality at 1.3095. The 1.2805 area provides the downside limit for corrective weakness.

GBP/USD

Friday's inside day tests key support at 1.5230, but this area is expected to survive during Monday's session and prompt a recovery back towards last week's bullish outside week high at 1.5470. A break above 1.5400 is required to lift the tone and open the 1.5445 lower high, which stands in the way of the 1.5470 peak. Only a sustained break below 1.5230 would concern bulls at this stage, exposing 1.5209 and 1.5191.

Friday, July 16, 2010

Fxpro Info

EUR/USD

Thursday's strength extends the strong near-term bull trend to validate the break above a seven-month bear trendline around 1.2750, and resistance at 1.2955 is set to come under fresh pressure. The psychological 1.3000 level looms ahead, but with a cluster of upside targets in the 1.3095/1.3120 area suggests there is scope for a push above 1.3000. Corrective weakness will attract support while above 1.2830, which protects the 1.2811 higher intraday low.

GBP/USD

Bulls have sustained the break above 1.5240 following Thursday's strong move higher, and resistance at 1.5470 is likely to face a retest. The lower high at 1.5498 is close to psychological resistance, but bull momentum is likely to run out near the April 15 lower reaction high at 1.5524. A key falling long-term daily moving average lies at 1.5530. There is risk of corrective weakness towards 1.5351, but 1.5295 should contain consolidation.

Thursday's strength extends the strong near-term bull trend to validate the break above a seven-month bear trendline around 1.2750, and resistance at 1.2955 is set to come under fresh pressure. The psychological 1.3000 level looms ahead, but with a cluster of upside targets in the 1.3095/1.3120 area suggests there is scope for a push above 1.3000. Corrective weakness will attract support while above 1.2830, which protects the 1.2811 higher intraday low.

GBP/USD

Bulls have sustained the break above 1.5240 following Thursday's strong move higher, and resistance at 1.5470 is likely to face a retest. The lower high at 1.5498 is close to psychological resistance, but bull momentum is likely to run out near the April 15 lower reaction high at 1.5524. A key falling long-term daily moving average lies at 1.5530. There is risk of corrective weakness towards 1.5351, but 1.5295 should contain consolidation.

Todays returns

Late post for 15 July.

1 trade today, 1 winner.

Month to date 5 winners 1 loser ROI 8.8%.

See my trades at forexfactory under useful links where trades and charts are posted.

1 trade today, 1 winner.

Month to date 5 winners 1 loser ROI 8.8%.

See my trades at forexfactory under useful links where trades and charts are posted.

Wednesday, July 14, 2010

Todays returns

1 trade today, 1 winner.

Month to date 4 winners 1 loser ROI 6.3%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 4 winners 1 loser ROI 6.3%.

See my trades at forexfactory under useful links where trades and charts are posted.

Fxpro info

EUR/USD

Tuesday's definitive recovery off 1.2522 leaves a bullish outside day reversal candle and sets fresh two-month highs following the probe above 1.2723. The bear resistance line originating from the November 2009 reaction high at 1.5145 is now being challenged around 1.2740, but there is room for a break above there to meet the wave equality target at 1.2765, projected off the June 29 higher low at 1.2151. And with 1.2522 now a confirmed higher low, a strong push towards 1.2875 cannot be ruled out for Wednesday's session. Corrective weakness looks limited to the 1.2615/30 area.

GBP/USD

Tuesday's strength has extended into Wednesday's current session as the bull trap high at 1.5240 has been breached. The main threat is for a sustained break into fresh nine-week highs, opening the April 30 lower high at 1.5391, although a long-term moving average on the daily chart highlights resistance close to 1.5375. A break below 1.5191 would provide temporary respite, although support at 1.5100 is likely to limit downside scope.

Tuesday's definitive recovery off 1.2522 leaves a bullish outside day reversal candle and sets fresh two-month highs following the probe above 1.2723. The bear resistance line originating from the November 2009 reaction high at 1.5145 is now being challenged around 1.2740, but there is room for a break above there to meet the wave equality target at 1.2765, projected off the June 29 higher low at 1.2151. And with 1.2522 now a confirmed higher low, a strong push towards 1.2875 cannot be ruled out for Wednesday's session. Corrective weakness looks limited to the 1.2615/30 area.

GBP/USD

Tuesday's strength has extended into Wednesday's current session as the bull trap high at 1.5240 has been breached. The main threat is for a sustained break into fresh nine-week highs, opening the April 30 lower high at 1.5391, although a long-term moving average on the daily chart highlights resistance close to 1.5375. A break below 1.5191 would provide temporary respite, although support at 1.5100 is likely to limit downside scope.

Friday, July 9, 2010

Fxpro Info

EUR/USD

Continues to edge higher towards the 1.2737 wave equality target following the push above 1.2663, although upside momentum is waning. A more important wave equality target lies at 1.2765, projected off the June 29 higher low at 1.2151, and the long-term bear resistance line originating from the November 2009 reaction high at 1.5145 is at 1.2773 for Friday's current session. Corrective weakness will attract support around 1.2600/20, and only below 1.2553 would concern near-term bulls.

GBP/USD

A classic bull trap Thursday left the two-month high at 1.5240 stranded, and brings the focus down to the bottom of the range at 1.5070/82. The failure to attract follow-through above 1.5230 Thursday suggests the six-week recovery is close to its conclusion, and a break below 1.5070 would prompt a sharp downmove towards 1.4934. The July 1 higher low at 1.4876 lies below there. Above 1.5206 is required to suggest the 1.5240 high is vulnerable.

Continues to edge higher towards the 1.2737 wave equality target following the push above 1.2663, although upside momentum is waning. A more important wave equality target lies at 1.2765, projected off the June 29 higher low at 1.2151, and the long-term bear resistance line originating from the November 2009 reaction high at 1.5145 is at 1.2773 for Friday's current session. Corrective weakness will attract support around 1.2600/20, and only below 1.2553 would concern near-term bulls.

GBP/USD

A classic bull trap Thursday left the two-month high at 1.5240 stranded, and brings the focus down to the bottom of the range at 1.5070/82. The failure to attract follow-through above 1.5230 Thursday suggests the six-week recovery is close to its conclusion, and a break below 1.5070 would prompt a sharp downmove towards 1.4934. The July 1 higher low at 1.4876 lies below there. Above 1.5206 is required to suggest the 1.5240 high is vulnerable.

Thursday, July 8, 2010

Todays returns

2 trades today, 1 winner 1 break even.

Month to date 3 winners 1 loser ROI 3.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 3 winners 1 loser ROI 3.5%.

See my trades at forexfactory under useful links where trades and charts are posted.

Fxpro Info

EUR/USD

Tuesday's bullish outside day defines the short-term trend, and is consolidating beneath insignificant resistance at 1.2673. Having completed an inverse-head-and-shoulders pattern, the main threat is for further strength towards the wave equality target at 1.2765. Support lies at 1.2518 to protect Tuesday's low at 1.2479, and only below there would concern near-term bulls.

GBP/USD

The key resistance level at 1.5228 has once again beaten back strength, and suggests a triangle consolidation pattern may be underway. The probe below 1.5132 threatens to extend towards the range floor at 1.5070, and backup support lies at 1.5050. Another test of 1.5228 would suggest a breakthrough is not too far away, opening 1.5288.

Tuesday's bullish outside day defines the short-term trend, and is consolidating beneath insignificant resistance at 1.2673. Having completed an inverse-head-and-shoulders pattern, the main threat is for further strength towards the wave equality target at 1.2765. Support lies at 1.2518 to protect Tuesday's low at 1.2479, and only below there would concern near-term bulls.

GBP/USD

The key resistance level at 1.5228 has once again beaten back strength, and suggests a triangle consolidation pattern may be underway. The probe below 1.5132 threatens to extend towards the range floor at 1.5070, and backup support lies at 1.5050. Another test of 1.5228 would suggest a breakthrough is not too far away, opening 1.5288.

Wednesday, July 7, 2010

Todays returns

3 trades today, 1 winner 1 loser 1 break even.

Month to date 2 winners 1 loser ROI 2%.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 2 winners 1 loser ROI 2%.

See my trades at forexfactory under useful links where trades and charts are posted.

Fxpro Info

EUR/USD

Tuesday's bullish outside day defines the short-term trend, and is consolidating beneath insignificant resistance at 1.2673. Having completed an inverse-head-and-shoulders pattern, the main threat is for further strength towards the wave equality target at 1.2765. Support lies at 1.2518 to protect Tuesday's low at 1.2479, and only below there would concern near-term bulls.

GBP/USD

The key resistance level at 1.5228 has once again beaten back strength, and suggests a triangle consolidation pattern may be underway. The probe below 1.5132 threatens to extend towards the range floor at 1.5070, and backup support lies at 1.5050. Another test of 1.5228 would suggest a breakthrough is not too far away, opening 1.5288.

Tuesday's bullish outside day defines the short-term trend, and is consolidating beneath insignificant resistance at 1.2673. Having completed an inverse-head-and-shoulders pattern, the main threat is for further strength towards the wave equality target at 1.2765. Support lies at 1.2518 to protect Tuesday's low at 1.2479, and only below there would concern near-term bulls.

GBP/USD

The key resistance level at 1.5228 has once again beaten back strength, and suggests a triangle consolidation pattern may be underway. The probe below 1.5132 threatens to extend towards the range floor at 1.5070, and backup support lies at 1.5050. Another test of 1.5228 would suggest a breakthrough is not too far away, opening 1.5288.

Monday, July 5, 2010

Fxpro Info

EUR/USD

Bulls are in control of the near-term after setting a fresh six-week high at 1.2613 Friday. Consolidation is underway to validate the break above 1.2490, and although there is scope to the 1.2430 area, bulls are expected to cushion dips in the 1.2485 area to protect 1.2430. The main threat is for renewed bull pressure on the 1.2613 high, opening 1.2673 and wave equality at 1.2765.

GBP/USD

Resistance emerged at 1.5228 Friday to halt the strong rally off the July 1 reaction low at 1.4876, and consolidation is likely back towards support in the 1.5070 area. 1.5228 represents a key resistance cluster, and should therefore look to force a break below 1.5070 towards 1.5000, given the wider picture is that of a major bear trend. Above 1.5228 would prompt further gains towards 1.5395, and weaken the prominent 1.5524 lower reaction high from April.

Bulls are in control of the near-term after setting a fresh six-week high at 1.2613 Friday. Consolidation is underway to validate the break above 1.2490, and although there is scope to the 1.2430 area, bulls are expected to cushion dips in the 1.2485 area to protect 1.2430. The main threat is for renewed bull pressure on the 1.2613 high, opening 1.2673 and wave equality at 1.2765.

GBP/USD

Resistance emerged at 1.5228 Friday to halt the strong rally off the July 1 reaction low at 1.4876, and consolidation is likely back towards support in the 1.5070 area. 1.5228 represents a key resistance cluster, and should therefore look to force a break below 1.5070 towards 1.5000, given the wider picture is that of a major bear trend. Above 1.5228 would prompt further gains towards 1.5395, and weaken the prominent 1.5524 lower reaction high from April.

Thursday, July 1, 2010

Todays returns

2 trades today, 1 break even 1 winner.

Month to date 1 winner 0 losing 2% ROI.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 1 winner 0 losing 2% ROI.

See my trades at forexfactory under useful links where trades and charts are posted.

Tuesday, June 29, 2010

Todays returns

2 trades today, 1 break even 1 winner.

Month to date 13 winners 3 losing 19% ROI.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 13 winners 3 losing 19% ROI.

See my trades at forexfactory under useful links where trades and charts are posted.

Friday, June 25, 2010

Todays returns

2 trades today, 1 break even 1 winner.

Month to date 12 winners 3 losing 17% ROI.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 12 winners 3 losing 17% ROI.

See my trades at forexfactory under useful links where trades and charts are posted.

Tuesday, June 22, 2010

Fxpro Info

EUR/USD

Monday's sharp setback off 1.2490 leaves a bearish outside day reversal, and is looking to test support at 1.2270. Respite is expected in this area as it marks a 1.618 downside extension target, and protects the June 17 higher low at 1.2242. An upside break through 1.2368 is required to lift the tone, but resistance levels at 1.2398 and 1.2467 will look to protect the 1.2490 peak.

GBP/USD

Strong resistance emerged at 1.4937 Monday to protect the key 1.4968 level, and produce a wide-ranging bearish outside day reversal as support at 1.4735 comes under threat. A break below there is required to leave 1.4937 as a near-term bull failure, creating risk for further weakness towards the June 17 higher low at 1.4647. Resistance lies at 1.4849, but corrective gains need to force a break above 1.4891 in order to re-open the 1.4937 high.

Monday's sharp setback off 1.2490 leaves a bearish outside day reversal, and is looking to test support at 1.2270. Respite is expected in this area as it marks a 1.618 downside extension target, and protects the June 17 higher low at 1.2242. An upside break through 1.2368 is required to lift the tone, but resistance levels at 1.2398 and 1.2467 will look to protect the 1.2490 peak.

GBP/USD

Strong resistance emerged at 1.4937 Monday to protect the key 1.4968 level, and produce a wide-ranging bearish outside day reversal as support at 1.4735 comes under threat. A break below there is required to leave 1.4937 as a near-term bull failure, creating risk for further weakness towards the June 17 higher low at 1.4647. Resistance lies at 1.4849, but corrective gains need to force a break above 1.4891 in order to re-open the 1.4937 high.

Friday, June 18, 2010

Todays returns

1 trade today.

Month to date 11 winners 3 losing 15% ROI.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 11 winners 3 losing 15% ROI.

See my trades at forexfactory under useful links where trades and charts are posted.

Thursday, June 17, 2010

Todays returns

1 nice little trade today.

Month to date 10 winners 3 losing 10% ROI.

See my trades at forexfactory under useful links where trades and charts are posted.

Month to date 10 winners 3 losing 10% ROI.

See my trades at forexfactory under useful links where trades and charts are posted.

Wednesday, June 16, 2010

Fxpro Info

EUR/USD

Keeping support at 1.2150 intact Tuesday has prompted a fresh wave of bull pressure, which is set to extend above 1.2350 towards key projected resistance at 1.2406. A break above there would upgrade the recovery off last week's four-year low at 1.1876, opening the May 28 lower high at 1.2454 and leaving 1.1876 as a potential bear failure. Support lies at 1.2244, and only below 1.2210 would suggest a return to 1.2150 is on the cards.

GBP/USD

Maintains the strong short-term uptrend following the break above 1.4771, and the dominant threat is for further strength towards wave equality at 1.4891. However, there is scope for further strength to 1.4915 and 1.4968, which will look to protect the psychologically-important 1.5000 level. Tuesday's low at 1.4684 is likely to limit corrective weakness, and only below 1.4584 would concern bulls.

Keeping support at 1.2150 intact Tuesday has prompted a fresh wave of bull pressure, which is set to extend above 1.2350 towards key projected resistance at 1.2406. A break above there would upgrade the recovery off last week's four-year low at 1.1876, opening the May 28 lower high at 1.2454 and leaving 1.1876 as a potential bear failure. Support lies at 1.2244, and only below 1.2210 would suggest a return to 1.2150 is on the cards.

GBP/USD

Maintains the strong short-term uptrend following the break above 1.4771, and the dominant threat is for further strength towards wave equality at 1.4891. However, there is scope for further strength to 1.4915 and 1.4968, which will look to protect the psychologically-important 1.5000 level. Tuesday's low at 1.4684 is likely to limit corrective weakness, and only below 1.4584 would concern bulls.

Monday, June 14, 2010

Todays returns

2 trades 1 break even 1 losing trade. I am significantly below my month to date target. No reason to panic but I am not happy with my performance in the first 2 weeks of this month.

Month to date 8 winners 3 losing 7% ROI.

Month to date 8 winners 3 losing 7% ROI.

COT info

Large traders increased their short GBP positions and remain 5:1 long US$. So whilst these positions can take some time to play out the big boys play of sell GU over last few months still has legs down it seems.

So whilst I'm not averse to buying the right GU set ups bias still selling GU.

So whilst I'm not averse to buying the right GU set ups bias still selling GU.

Thursday, June 10, 2010

Fxpro info

EUR/USD

Thursday's strength is approaching Wednesday's doji candle high at 1.2074, but resistance here should be strong enough to protect higher resistance levels at 1.2100 and 1.2145. This would suggest a return to Thursday's current session low at 1.1957 is on the cards, in accordance with the wider dominant bear trend, and below 1.1957 would expose Tuesday's higher low at 1.1901.

GBP/USD

Builds on the recovery off Tuesday's reversal low at 1.4349, and is tackling resistance at Wednesday's high at 1.4608. While downside scope is limited to the 1.4475 area, there is room for a break above 1.4608 towards the June 4 lower high at 1.4680. Below 1.4514 would extend consolidation to the 1.4475 area, where a 1.618 extension target at 1.4443 provides backup support.

Thursday's strength is approaching Wednesday's doji candle high at 1.2074, but resistance here should be strong enough to protect higher resistance levels at 1.2100 and 1.2145. This would suggest a return to Thursday's current session low at 1.1957 is on the cards, in accordance with the wider dominant bear trend, and below 1.1957 would expose Tuesday's higher low at 1.1901.

GBP/USD

Builds on the recovery off Tuesday's reversal low at 1.4349, and is tackling resistance at Wednesday's high at 1.4608. While downside scope is limited to the 1.4475 area, there is room for a break above 1.4608 towards the June 4 lower high at 1.4680. Below 1.4514 would extend consolidation to the 1.4475 area, where a 1.618 extension target at 1.4443 provides backup support.

UK, Euro interest rate announcements

Both the UK and Euro have interest rate announcements today. Like NFP price action can be volatile and we generally would not trade. I have checked back 6 months on NFP and UK/Euro interest rate days and provided price action is not particularly slow or erratic these days appear to offer good system trades.

So we will be taking trades during London session when set ups occur on both NFP and UK/Euro interest rate days.

No trades today.

Month to date 10 trades 8 winners 2 losing, 9% ROI.

See my trades at forexfactory under useful links where trades and charts are posted real time.

So we will be taking trades during London session when set ups occur on both NFP and UK/Euro interest rate days.

No trades today.

Month to date 10 trades 8 winners 2 losing, 9% ROI.

See my trades at forexfactory under useful links where trades and charts are posted real time.

Wednesday, June 9, 2010

No trades today

Unfortunately the early part of London session had no system trades and I had to take a family member to the doctor and for x-rays etc etc and missed the good moves that occurred.

The upside is that the system again worked extremely well and produced highly profitable trades. As you can see under useful links my trades at forexfactory where I posted a chart of the system trades missed.

The upside is that the system again worked extremely well and produced highly profitable trades. As you can see under useful links my trades at forexfactory where I posted a chart of the system trades missed.

Tuesday, June 8, 2010

Todays returns

2 trades 2 winners, 3% ROI for the day.*

Month to date 10 trades 8 winners 2 losing, 9% ROI.

*Mrs V set the trade size at half of normal so whilst 3% for the day is good these trades would normally yield 6% ROI for the day.

See my trades at forexfactory under useful links where trades and charts posted real time.

Month to date 10 trades 8 winners 2 losing, 9% ROI.

*Mrs V set the trade size at half of normal so whilst 3% for the day is good these trades would normally yield 6% ROI for the day.

See my trades at forexfactory under useful links where trades and charts posted real time.

Fxpro Info

The return of the carry trade has been postponed - once again. Rising concern about European debt contagion and falling optimism about the global recovery may be encouraging more investors to move out of the euro. But instead of heading into higher risk commodity currencies, such as the Australian, New Zealand and Canadian dollars, they are moving into safe havens, such as the dollar, the yen and the Swiss franc. Given recent events, there is every reason this trend will continue. Data from China this week will only make matters worse if the figures confirm that the Beijing government has succeeded in slowing the economy down. This will only contribute to fears that the global economy could yet face a double-dip recession. In recent weeks, economic data from the euro zone and Japan have consistently been below expectations. And now, there is concern that U.S. growth could be stalling too after last Friday's disappointingly small rise in non-farm payrolls. Manuel Oliveri, a currency strategist with UBS in Zurich summed it up: "We expect growth expectations to adjust further, and one cannot exclude that stock markets may increasingly start to reflect the risk of a double dip recession." On top of this, contagion fears in the euro zone are growing.

Fxpro Info

EUR/USD

Stages a corrective recovery off Monday's low at 1.1876 to temporarily halt the dominant bear trend, and is attempting to test the 1.1992 high. However, resistance lies at 1.2030 and, more significantly, at 1.2100 which provides the limit for potential upside scope. A break below 1.1912 is required to put bears back in control, exposing 1.1876 and threatening to extend the bear trend to the 1.1794 area.

Stages a corrective recovery off Monday's low at 1.1876 to temporarily halt the dominant bear trend, and is attempting to test the 1.1992 high. However, resistance lies at 1.2030 and, more significantly, at 1.2100 which provides the limit for potential upside scope. A break below 1.1912 is required to put bears back in control, exposing 1.1876 and threatening to extend the bear trend to the 1.1794 area.

Fxpro Info

GBP/USD

Stages a corrective recovery off Monday's low at 1.4391, and while support at 1.4460 holds, there is room for a return to the 1.4563 high. However, the June 2 reaction high at 1.4771 is likely to become a significant high, and is part of a solid resistance cluster, so upside scope look limited at this stage. Loss of 1.4460 would put near-term bears back in control and bring the focus back onto the 1.4391 low.

Stages a corrective recovery off Monday's low at 1.4391, and while support at 1.4460 holds, there is room for a return to the 1.4563 high. However, the June 2 reaction high at 1.4771 is likely to become a significant high, and is part of a solid resistance cluster, so upside scope look limited at this stage. Loss of 1.4460 would put near-term bears back in control and bring the focus back onto the 1.4391 low.

Monday, June 7, 2010

Todays returns

A family accident cut short the days trading missing the best system trades of the day.

Took 2 trades 1 winner 1 loser for -1% for the day.

Month to date 8 trades 6 winners 2 losers, 6% ROI for the month.

See my trades at forexfactory under useful links where trades and charts posted real time.

Took 2 trades 1 winner 1 loser for -1% for the day.

Month to date 8 trades 6 winners 2 losers, 6% ROI for the month.

See my trades at forexfactory under useful links where trades and charts posted real time.

Friday, June 4, 2010

Thursday, June 3, 2010

Fxpro information

From fxpro

GBP/USD

Suffered a setback off 1.4771 Wednesday to leave a cautious doji on the daily chart, as resistance in this key area below 1.4805 begins to emerge. Attempts to retest 1.4771 should be beaten back to protect 1.4805, but to extend the rally off the May 20 reaction low at 1.4229, a fresh wave of bull pressure is needed, opening the 1.5053 lower high. Below 1.4621 would expose Wednesday's low at 1.4554, but 1.4435 provides backup support.

GBP/USD

Suffered a setback off 1.4771 Wednesday to leave a cautious doji on the daily chart, as resistance in this key area below 1.4805 begins to emerge. Attempts to retest 1.4771 should be beaten back to protect 1.4805, but to extend the rally off the May 20 reaction low at 1.4229, a fresh wave of bull pressure is needed, opening the 1.5053 lower high. Below 1.4621 would expose Wednesday's low at 1.4554, but 1.4435 provides backup support.

Todays returns

Had limited time trading today as the better half is off sick (pneumonia again) and I had to run to the shops to get her medicine etc etc etc. So 1 trade today for 2% ROI. With lots of employment related news coming out of the US this afternoon I may call it a day here.

Return for the month so far 7%. 6 trades 5 winners 1 losing.

Return for the month so far 7%. 6 trades 5 winners 1 losing.

Chart Patterns

I've added a useful link for a comprehensive list of chart patterns. See Chart Patterns - Bulkowski's Visual Index .

Wednesday, June 2, 2010

Todays returns

I might be finished for the day here. 3.5% ROI for the day but still not quite happy. There were some moves with candles not lining up and a nice higher low (hl) not taken on ej as we were very close to an even number. So perhaps I shouldn't be too unhappy.

Return for the month so far 5%. 5 trades 4 winners 1 losing.

Return for the month so far 5%. 5 trades 4 winners 1 losing.

Tuesday, June 1, 2010

Todays returns

A hugely disappointing day. Did 1.5% ROI but due to having to go out unexpectedly and some connection issues lost out on some very solid opportunities. The kind of day where you can do well above 10% ROI.

Part of the disappointment comes from the May 30th blog on COT in the coming week where some ej weakness was anticipated and it fell like a stone.

These potentially big days should be the buffer for tough days where everything doesn't play out as you'd like.

It won't be the first time real life interrupts trading and certainly won't be the last. No problem we'll have another go tomorrow.

Part of the disappointment comes from the May 30th blog on COT in the coming week where some ej weakness was anticipated and it fell like a stone.

These potentially big days should be the buffer for tough days where everything doesn't play out as you'd like.

It won't be the first time real life interrupts trading and certainly won't be the last. No problem we'll have another go tomorrow.

European problems.

From FXPro.

Europe

The euro fell to a new four-year low against the dollar Tuesday as concern over euro-zone banks, euro-zone sovereign debtors and the future of Angela Merkel's coalition government took their toll. General market sentiment was also being undermined by weak Chinese data, fear that the Japanese prime minister could resign and the Israeli attack on aid ships headed for the Gaza Strip. Investors were reacting to all this global upheaval with another pull out of risky assets that sent both Asia and European stock markets sharply lower. The latest rot set in Friday when Fitch downgraded Spain's sovereign debt rating and triggered a new sell-off in the bonds of euro-zone debtors. The European Central Bank also became part of the problem as the bank's recent policy of buying government bonds proved divisive. Officials at Germany's central bank are questioning the policy, which could weaken the ECB's credibility. The ECB also issued a warning about euro-zone banks, predicting that they could face another EUR195 billion of bad-debt writedowns over the next 18 months. Fears about the impact this will have on balance sheets means that financing conditions for euro-zone banks could deteriorate even more, making economic recovery for the region that much more difficult. In the meantime, Germany's ruling coalition came one step closer to collapse after German President Horst Kohler resigned unexpectedly. This was more bad news for Chancellor Merkel, who is already facing difficulty with smaller parties in her ruling coalition over plans to hike taxes to help fund the country's budget deficit.

Europe

The euro fell to a new four-year low against the dollar Tuesday as concern over euro-zone banks, euro-zone sovereign debtors and the future of Angela Merkel's coalition government took their toll. General market sentiment was also being undermined by weak Chinese data, fear that the Japanese prime minister could resign and the Israeli attack on aid ships headed for the Gaza Strip. Investors were reacting to all this global upheaval with another pull out of risky assets that sent both Asia and European stock markets sharply lower. The latest rot set in Friday when Fitch downgraded Spain's sovereign debt rating and triggered a new sell-off in the bonds of euro-zone debtors. The European Central Bank also became part of the problem as the bank's recent policy of buying government bonds proved divisive. Officials at Germany's central bank are questioning the policy, which could weaken the ECB's credibility. The ECB also issued a warning about euro-zone banks, predicting that they could face another EUR195 billion of bad-debt writedowns over the next 18 months. Fears about the impact this will have on balance sheets means that financing conditions for euro-zone banks could deteriorate even more, making economic recovery for the region that much more difficult. In the meantime, Germany's ruling coalition came one step closer to collapse after German President Horst Kohler resigned unexpectedly. This was more bad news for Chancellor Merkel, who is already facing difficulty with smaller parties in her ruling coalition over plans to hike taxes to help fund the country's budget deficit.

GU view

3rd party information.

GBP/USD

Stages a recovery off Monday's low at 1.4434 to threaten to re-open last Friday's 1.4610 high. Last week's bullish doji at the base of a sharp decline suggests a significant basing attempt is underway, and while projected support at 1.4333 remains intact, there is upside scope for further strength towards 1.4640 and the 1.618 extension target at 1.4745. However, the recovery should be limited to resistance from former range lows at 1.4785, and projected resistance at 1.4805. Only a break below 1.4333 would put near-term bears in control, exposing 1.4229/60.

GBP/USD

Stages a recovery off Monday's low at 1.4434 to threaten to re-open last Friday's 1.4610 high. Last week's bullish doji at the base of a sharp decline suggests a significant basing attempt is underway, and while projected support at 1.4333 remains intact, there is upside scope for further strength towards 1.4640 and the 1.618 extension target at 1.4745. However, the recovery should be limited to resistance from former range lows at 1.4785, and projected resistance at 1.4805. Only a break below 1.4333 would put near-term bears in control, exposing 1.4229/60.

Candles, what are we looking for

The candles that we look for eg hammers, shooting stars, doji's, railway tracks, inside bars, outside bars, double top high lower close and double bottom low higher close.

When we enter from 5 or 1 min we want to sell on candles that have little or no lower wick and buy candles that have little or no upper wick.

If it seems that we are selling the lower wick of say a 15 min hammer, we'll actually be selling either a 5 min or 1 min closed candle with little/no lower wick. Price must move 1 pip beyond the low of the candle to confirm the sell trade.

There are numerous charts on my thread at forexfactory that show this, see under useful links.

When we enter from 5 or 1 min we want to sell on candles that have little or no lower wick and buy candles that have little or no upper wick.

If it seems that we are selling the lower wick of say a 15 min hammer, we'll actually be selling either a 5 min or 1 min closed candle with little/no lower wick. Price must move 1 pip beyond the low of the candle to confirm the sell trade.

There are numerous charts on my thread at forexfactory that show this, see under useful links.

Monday, May 31, 2010

UK and US holidays today

Whilst there can be trades on such days I'll watch charts a little longer but will probably take the day off and do some admin.

So it looks like we'll start trading tomorrow.

So it looks like we'll start trading tomorrow.

Key levels, will they hold or fail

There are numerous key levels on any chart. For example previous support and resistance levels, pivots, round numbers, fib's. The more important the level the bigger the reaction should be. There are some very good traders out there that can identify and trade these key levels.

I look to exit trades at key levels and then look for a reaction. As an example if a certain price caused a 200 pip move previously and comes back hits and moves 40, hits again and moves 20 (hopefully you've been in all the trades in direction of trend). Those smaller bounces away from the key level are usually pretty good indications that the key level will fail.

Nothing works 100% (as previously mentioned and price will do what it wants) but apart from the hope that we will have been in the moves (trading higher lows and lower highs) to the key levels, we look at the size of bounces. If the bounces are getting smaller we'll look for the right candles to see if that key level will fail.

Higher lows/lower highs from these levels provide opportunities to enter the market at extremes.

I look to exit trades at key levels and then look for a reaction. As an example if a certain price caused a 200 pip move previously and comes back hits and moves 40, hits again and moves 20 (hopefully you've been in all the trades in direction of trend). Those smaller bounces away from the key level are usually pretty good indications that the key level will fail.

Nothing works 100% (as previously mentioned and price will do what it wants) but apart from the hope that we will have been in the moves (trading higher lows and lower highs) to the key levels, we look at the size of bounces. If the bounces are getting smaller we'll look for the right candles to see if that key level will fail.

Higher lows/lower highs from these levels provide opportunities to enter the market at extremes.

Sunday, May 30, 2010

Searching for a trading system

If you are searching for people to trade for you click on Trading Systems under useful links.

Personally I do not use this. The services I use/have used are the cashbackforex rebates and the forexexmentor. Both links above.

Personally I do not use this. The services I use/have used are the cashbackforex rebates and the forexexmentor. Both links above.

My basic trades, higher lows and lower highs

I'll explain my methods here but go to forexfactory to see these explained with charts, see the "useful links". These are the regular trades I look to enter.

A good trader said to me that the first retracement is the best trade, ie the first higher low/lower high in a move. These retracements provide good opportunities to enter into a move with a relatively small stop loss.

There are 3 trades to consider:

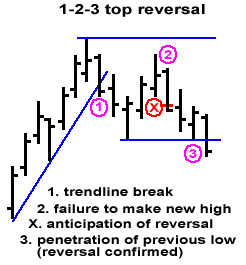

1)Higher lows and lower highs on 5 min charts can be taken at extremes (also known as 1 2 3 tops/bottoms). I would want to see the reversal at a key level ie previous support/resistance area, pivot, round number etc etc.

2)What I'll call 100% system trades that will follow the 1hr with entry from 5 min higher lows and lower highs. I do not want to see an obvious contra indication from 15 min, e.g. I would not want to be selling a 5 min lh immediately after a high vol hammer on 15 min. I would like to be selling a 5 min lh after an engulfing negative close candle/shooting star with little/no lower wick on 15 min.

3)A 2b reversal trade which is a variation of 123 top/bottom and is also an indication of a test and failure. We only look at 2b trades in and around London open, at a key level with a move back into the trend on D.

"In an uptrend, if prices penetrate the previous high but fail to carry through and immediately drop below the previous high, the trend is apt to reverse. The converse is true for downtrends." [Vic Sperandeo in "Trader Vic: Methods of a Wall Street Master"]

General

Some knowledge of candlestick analysis is required as you want to be trading the right candles.

Some of the key items are: consider key levels for turns (eg round numbers, D and W pivots, some fibs), follow the 1hr, are we above or below the 1hr 8 lwma, 5 min hl/lh's. A cross of an 8 lwma on the 5 min chart gives an easy visual clue of a higher low or lower high in most cases. Once set up on 5 min price should move a pip or so beyond the high low of the set up candle to confirm the trade.

NB Watching and trading the right candles is always important. London open typically has a head fake, this turn can happen quickly which is why we look for a decent 15 min candle at least. The pre US session can take a couple of hours to turn and there we need more than a 15 min candle, a good 1hr set up minimum. Avoid weak pre/early US open counter trend candles on 1hr, they are often fake out moves. The 1hr higher low, lower high intra day that reverts to trend is a much better set up.

Always be looking to assess the trend from D, then 1hr flows i.e. 1hr higher lows and lower highs. For example you assess D as downtrend but last 1hr flow is higher high, higher low. Then you have a counter trend rally and might need to wait for 1hr to revert to lower high before selling again.

Stops: Around 15 pips 1.5% of capital. Typically to the last 5 min swing high/low.

Exits: Depends on where you entered in a run. I look to target areas where bounces or turns are likely to occur.

COT possibilities in the week ahead

3rd party report.

There has been SIGNIFICANT buying and closing of short sales this week in JPY. If

its strong next week trade it against the weakest pair at the time.

The EUR has been sold for a long time but traders closed out some of their long positions and this the % short in EUR has increased nicely. If EUR is weak next week consider selling it against the JPY above if JPY is strong at the time.

Looks like I might have to change focus from gu to ej a little in the coming week.

There has been SIGNIFICANT buying and closing of short sales this week in JPY. If

its strong next week trade it against the weakest pair at the time.

The EUR has been sold for a long time but traders closed out some of their long positions and this the % short in EUR has increased nicely. If EUR is weak next week consider selling it against the JPY above if JPY is strong at the time.

Looks like I might have to change focus from gu to ej a little in the coming week.

Saturday, May 29, 2010

Why trade forex

There are some tremendous advantages:

1)The barriers to entry are low, basically means you can start with a few hundred dollars to fund an account and buy a course.

2)No staff, no offices, no stock (to buy, hold, insure, sell) and very little equipment. You need a computer and an internet connection.

3)The bank will lend you money ie you can leverage your account. Ever tried borrowing money from a bank after a financial crisis? You have to be very, very strong financially or the answer is no.

4)Its portable, you can take this anywhere in the world.

5)It's flexible, choose your hours and no commute to work. You're the boss.

That however means there are some dis-advantages:

1)Low barriers to entry ie it didn't cost much to get going may mean you don't put in the effort necessary to make it work.

2)You may want (need?) to make it all happen tomorrow or see this as a quick fix for other (financial?) problems.

3)Think it looks so easy, jump in all over the place and lose money. Ever wondered why top sportsmen have coach's and mentor's. The mental side of trading is crucial.

Get this business right and potentially you have a great opportunity, if you can get that idea right in your mind at the start and put in the effort you'll have an advantage. It takes work (well at least it did for me).

1)The barriers to entry are low, basically means you can start with a few hundred dollars to fund an account and buy a course.

2)No staff, no offices, no stock (to buy, hold, insure, sell) and very little equipment. You need a computer and an internet connection.

3)The bank will lend you money ie you can leverage your account. Ever tried borrowing money from a bank after a financial crisis? You have to be very, very strong financially or the answer is no.

4)Its portable, you can take this anywhere in the world.

5)It's flexible, choose your hours and no commute to work. You're the boss.

That however means there are some dis-advantages:

1)Low barriers to entry ie it didn't cost much to get going may mean you don't put in the effort necessary to make it work.

2)You may want (need?) to make it all happen tomorrow or see this as a quick fix for other (financial?) problems.

3)Think it looks so easy, jump in all over the place and lose money. Ever wondered why top sportsmen have coach's and mentor's. The mental side of trading is crucial.

Get this business right and potentially you have a great opportunity, if you can get that idea right in your mind at the start and put in the effort you'll have an advantage. It takes work (well at least it did for me).

Discipline ............

Discipline is the bridge between goals and accomplishments.

If you can get this simple concept right you'll probably have a great trading career. The only trick is it's a massive all embracing concept.

Discipline to:

1)Take the time and effort to check your trading plan works (in up/down/ranging markets).

2)Execute flawlessly. This doesn't mean every trade is a winner (they won't be) but it means to trade when you see your rules play out.

3)Not chase a move simply because you are scared you'll miss out, there are more trades coming.

4)Know the difference between a price move and a trade. A trade is something that complies with your rules. A price move is a random jump in the market that you couldn't have anticipated.

So plan your trades, trade your plan and avoid the wrong trades.

If you can get this simple concept right you'll probably have a great trading career. The only trick is it's a massive all embracing concept.

Discipline to:

1)Take the time and effort to check your trading plan works (in up/down/ranging markets).

2)Execute flawlessly. This doesn't mean every trade is a winner (they won't be) but it means to trade when you see your rules play out.

3)Not chase a move simply because you are scared you'll miss out, there are more trades coming.

4)Know the difference between a price move and a trade. A trade is something that complies with your rules. A price move is a random jump in the market that you couldn't have anticipated.

So plan your trades, trade your plan and avoid the wrong trades.

Some gbpusd thoughts

Nothing works 100% of the time, some things happen regularly enough to take note of. These are some of those thoughts on trading gbpusd.

1)GU likes 50% fib's

2)GU likes the 25/75 psych levels

3)The first 15 minutes in Frankfurt trading (European open, Frankies hour or FH) is often a fake out and we rarely trade then.

4)A typical range for FH is 40 pips, upper range 60.

5)Bank your pips in FH.

6)We do not trade a 2nd move in same direction in FH, especially if the range is close to complete and we 30 mins in that hour.

7)Frankie often has a half hour reversal. Some traders I like think the FH move is often just a fake out move for the London session. Some call it the London open head fake.

8)Stop sweeps. If price is falling and goes below 15, it can often fall below the even number to 85. The opposite is also true if price is rising through 85 area it can often go above the round number to 15.

9)We like to trade London session until price has moved around 125 pips.

10)UK News events generally move GU in 1 direction (US news events can be much more volatile).

1)GU likes 50% fib's

2)GU likes the 25/75 psych levels

3)The first 15 minutes in Frankfurt trading (European open, Frankies hour or FH) is often a fake out and we rarely trade then.

4)A typical range for FH is 40 pips, upper range 60.

5)Bank your pips in FH.

6)We do not trade a 2nd move in same direction in FH, especially if the range is close to complete and we 30 mins in that hour.

7)Frankie often has a half hour reversal. Some traders I like think the FH move is often just a fake out move for the London session. Some call it the London open head fake.

8)Stop sweeps. If price is falling and goes below 15, it can often fall below the even number to 85. The opposite is also true if price is rising through 85 area it can often go above the round number to 15.

9)We like to trade London session until price has moved around 125 pips.

10)UK News events generally move GU in 1 direction (US news events can be much more volatile).

Friday, May 28, 2010

Getting started

Where to start, that's what you'll be thinking. All I can do is tell you what I did.

First of all you can go to the "get forex rebates" link above and choose a company you are happy with and download their demo platform. Literally play around to get comfortable with the platform and how things work. You can fund a live account and still demo trade. Don't be tempted to trade live until you are comfortable with your methods. Money management is key, I don't risk more than 2% on any one trade. Often only 1-1.5%.

There's lots of information available from forexfactory, babypips and the free video course links above. Putting it all together into something that works for you is the trick. It can take some time to figure out.

I started with a course from Peter Bain's Forexmentor (discount available from the get forex rebates link above). I believe him to be an honourable person giving a good course.

At the time Seth Gregory also worked in association with Peter. Seth has now branched out onto his own and the link to his site is also above. I was always extremely impressed with Seth, his methods, attitude and trading skills. I'd recommend him based on what I experienced. He has some free information and other services. If you want to get going trading live whilst you learn you need to plug into a proven system. Seth's forex active trader is an option to consider. He has a $19.99 14 day trial which would give you access to trades and if you are happy with how things are going ie making money you can consider extending month by month whilst you learn to trade.