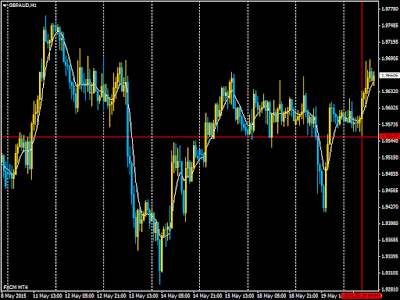

As always showing the importance of the W pivots, support and resistance levels and the numbers of moves that can be expected in a week (typically 2-5).

All the world's a stage and we are merely players. Discipline is the bridge between goals and accomplishment.

Sunday, May 24, 2015

Friday, May 22, 2015

Agreement across pairs 22 May

Both euraud and eurnzd bounced from support levels as seen on 1hr. Even without that the 5 min stochastic is above the 50 level after London open (green line) and we have multiple bottoms/higher lows. So we have agreement across pairs and the bias is up. The focus would then switch to the 1 min to find higher lows for entry.

Wednesday, May 20, 2015

Agreement across pairs - Following the 1hr?

To be successful as a trader one of the many things you need to do is get comfortable with the time frame you are trading. I am comfortable taking entries off the 1 min chart as per recent posts in the last couple of months.

It is not however a case of jumping in and trying to scalp every move which I accept that I cannot do and certainly don't want to start trying. It is using some basic information to try and gauge strength and weakness for short term trend and to use support and resistance levels.

See some of the recent posts titled agreement across pairs. Basically looking for 5 min charts to show some form of agreement between different pairs to confirm that you are trading broader strength/weakness:

- a cross above/below stochastic 20 20 1 (same as W% R 20), then

- making double bottoms/higher lows or double tops/lower highs

Additional information can be gained from higher time frame charts that just focusing on 1 min can easily miss.

Today there were easily identifiable support levels on gbpaud, gbpnzd, and euraud. The 9 am 1 hr candles for the gbp pairs and euraud were positive closes rejecting a move lower. There is agreement then between gbp against aud and nzd and euraud. So now you have an identified support level, agreement across pairs for a move up. In terms of this strategy we would be looking for agreement on the 5 min stochastic above the 50 level and double bottoms/higher lows.

Then we would be looking at the 1 min to see which pair is highest on Clives TT indicator (measures the steepness of moving averages) and giving the cleanest higher lows/a b c moves to time our entry in line with the short term trend.

It is not however a case of jumping in and trying to scalp every move which I accept that I cannot do and certainly don't want to start trying. It is using some basic information to try and gauge strength and weakness for short term trend and to use support and resistance levels.

See some of the recent posts titled agreement across pairs. Basically looking for 5 min charts to show some form of agreement between different pairs to confirm that you are trading broader strength/weakness:

- a cross above/below stochastic 20 20 1 (same as W% R 20), then

- making double bottoms/higher lows or double tops/lower highs

Additional information can be gained from higher time frame charts that just focusing on 1 min can easily miss.

Today there were easily identifiable support levels on gbpaud, gbpnzd, and euraud. The 9 am 1 hr candles for the gbp pairs and euraud were positive closes rejecting a move lower. There is agreement then between gbp against aud and nzd and euraud. So now you have an identified support level, agreement across pairs for a move up. In terms of this strategy we would be looking for agreement on the 5 min stochastic above the 50 level and double bottoms/higher lows.

Then we would be looking at the 1 min to see which pair is highest on Clives TT indicator (measures the steepness of moving averages) and giving the cleanest higher lows/a b c moves to time our entry in line with the short term trend.

Sunday, May 10, 2015

4hr charts W pivots

Just showing again to point out the importance of the W pivots, support and resistance areas and generally the number of good moves that can be expected in a week (typically 2-5).

GBPAUD sell 101 pips

The gbpaud daily chart clearly shows the potential resistance level around W M4 1.9637. Sold 1.9630. We were out on Friday afternoon so missed an opportunity to exit but +101 pips is not the worst ending for the trade.

Friday, May 8, 2015

Agreement across pairs number 2 - 8 May 2015

Fairly straight forward gbp crosses giving lower highs crossing stochastic (20 20 1) 50 level, see the red lines. There is agreement that gbp is weakening. So from there the focus is on sells, which pair is highest on TT indicator and then looking at 1 minute for clean a b c moves lower.

Agreement across pairs

Apart from a gbpaud sell earlier this morning at 1.9630, which is at break even, my attention was elsewhere partly due to it being NFP so these charts have not been traded.

As mentioned in a previous post my intra day trades are still based on the tried and trusted higher lows/lower highs i.e. a b c moves. Looking for short term trend from Clives TT indicator on 1 minute charts with assistance from 5 min charts stochastic 20 20 1 (same as W% R 20) 50 level to help identify set ups.

This morning before London open (green line) gbpnzd and eurnzd were "agreeing" with price moving above the 20lwma and the 50 level on stochastic 20 20 1. So our bias for these nzd pairs is up. About 10 candles after London open euraud also starts agreeing with a higher low closing above the moving average/stoch 50 level. Using this trend definition eurjpy had agreed for some time. When euraud moves eurnzd has a higher low close at the same time.

Whilst its not always a perfect science for picking a trade just looking to make the point again. NZD is weak as we are up against gbp and eur. When eur shows strength against several pairs then eurnzd appears the right choice to trade. Eur strength across many pairs, nzd weakness.

Once the pair is identified using the above trend definition then I'll be looking to enter from 1 or 5 min higher lows/lower highs with the help of the TT indicator. General targets 50 pips.

As mentioned in a previous post my intra day trades are still based on the tried and trusted higher lows/lower highs i.e. a b c moves. Looking for short term trend from Clives TT indicator on 1 minute charts with assistance from 5 min charts stochastic 20 20 1 (same as W% R 20) 50 level to help identify set ups.

This morning before London open (green line) gbpnzd and eurnzd were "agreeing" with price moving above the 20lwma and the 50 level on stochastic 20 20 1. So our bias for these nzd pairs is up. About 10 candles after London open euraud also starts agreeing with a higher low closing above the moving average/stoch 50 level. Using this trend definition eurjpy had agreed for some time. When euraud moves eurnzd has a higher low close at the same time.

Whilst its not always a perfect science for picking a trade just looking to make the point again. NZD is weak as we are up against gbp and eur. When eur shows strength against several pairs then eurnzd appears the right choice to trade. Eur strength across many pairs, nzd weakness.

Once the pair is identified using the above trend definition then I'll be looking to enter from 1 or 5 min higher lows/lower highs with the help of the TT indicator. General targets 50 pips.

Thursday, May 7, 2015

Using 5 min stochastic 20 20 1

I wouldn't normally suggest using one time frame alone as your sole source of information for trading decisions. Also we want to look for agreement across pairs, here we are looking at eur against aud, jpy and nzd.

Euraud 1hr has a shooting star at the highs from the last 5 days, eurjpy a shooting star at a level that it has struggled to break above for the last 24 hours.

Looking at the 5 min charts, from 12.55 on euraud to 13.05 on eurnzd all 3 pairs have completed lower highs that have closed below their 50 level on stochastic 20 20 1. We would then look at 1 minute charts to time an entry on the next clean lower high/a b c move on the pair with the highest TT score.

So what would be the reasons for a sell:

- reaction to clearly visible resistance levels

- good 1hr closes, shooting stars with large upper wicks

- agreement across eur pairs with 5 min lower highs and stochastic 20 20 1 below the 50 level

Euraud 1hr has a shooting star at the highs from the last 5 days, eurjpy a shooting star at a level that it has struggled to break above for the last 24 hours.

Looking at the 5 min charts, from 12.55 on euraud to 13.05 on eurnzd all 3 pairs have completed lower highs that have closed below their 50 level on stochastic 20 20 1. We would then look at 1 minute charts to time an entry on the next clean lower high/a b c move on the pair with the highest TT score.

So what would be the reasons for a sell:

- reaction to clearly visible resistance levels

- good 1hr closes, shooting stars with large upper wicks

- agreement across eur pairs with 5 min lower highs and stochastic 20 20 1 below the 50 level

AUD NZD agreement

For some time now I have been focusing on different pairs confirming strength. I have been using, courtesy of Clive from Forex Factory, what he calls a TT indicator. This measures the slope of a moving average. The higher the number the stronger the move and therefore the better the trend on that timeframe (we accept that trend is time frame dependent).

I also use a visual correlation between the 6 pairs charts I have up (gbpaud, gbpjpy and gbpnzd with the same eur crosses). I like pairs to agree, yes its easier when there is broad strength or weakness for a currency and many of its crosses are up/down (here the TT indicator might have 4-5 or more pairs featuring 1 currency). At a minimum I want two pairs to agree, say aud is weak against gbp and eur or in this mornings case eur was strong against aud and nzd. I have been watching the aud and nzd correlation between eur and gbp for some time now.

This morning there was more information:

- the 1hr charts for euraud and eurnzd show the higher high higher low confirmation of the trend higher.

- at London open (green line) the 5 min charts are above their moving averages and they are making higher lows which suggests now the short term trend is in line with the 1hr.

- of course we now have agreement between pairs suggesting the eur is strong and aud, nzd weak.

- the stochastic 20, 20, 1 (same as W% R 20) are above the 50 level.

I also use a visual correlation between the 6 pairs charts I have up (gbpaud, gbpjpy and gbpnzd with the same eur crosses). I like pairs to agree, yes its easier when there is broad strength or weakness for a currency and many of its crosses are up/down (here the TT indicator might have 4-5 or more pairs featuring 1 currency). At a minimum I want two pairs to agree, say aud is weak against gbp and eur or in this mornings case eur was strong against aud and nzd. I have been watching the aud and nzd correlation between eur and gbp for some time now.

This morning there was more information:

- the 1hr charts for euraud and eurnzd show the higher high higher low confirmation of the trend higher.

- at London open (green line) the 5 min charts are above their moving averages and they are making higher lows which suggests now the short term trend is in line with the 1hr.

- of course we now have agreement between pairs suggesting the eur is strong and aud, nzd weak.

- the stochastic 20, 20, 1 (same as W% R 20) are above the 50 level.

Wednesday, May 6, 2015

EURAUD 198 pips

Sold EURAUD and with the UK elections tomorrow exited when yesterdays lows held for some time for +198.

GBPAUD test of range

I received a comment (my apologies for late reply didn't see the original post as awaiting moderation) about break and test of range and test of range. Is test of range as good a signal as break and test.

My comment yesterday 5 May 2015, see http://vantagefx.blogspot.com/2015/02/london-open-27-feb-15.html was "All I can suggest is to be aware and watch out for it. But remember you are looking for all the elements i.e. a failed move in a direction, clean move to other end of range, small retrace and then finally some agreement from other pairs for confirmation of strength/weakness. For example gbp weakness in the above post. Putting all together does give a strong signal."

This morning GBPAUD we have a failed move up around London open with multiple tops, a clean move to the lower range (red line), small retrace and agreement from other GBP pairs (below their moving averages and giving lower highs) showing GBP general weakness. As mentioned several times I like the correlation GBPAUD and GBPNZD when they are agreeing on direction.

My comment yesterday 5 May 2015, see http://vantagefx.blogspot.com/2015/02/london-open-27-feb-15.html was "All I can suggest is to be aware and watch out for it. But remember you are looking for all the elements i.e. a failed move in a direction, clean move to other end of range, small retrace and then finally some agreement from other pairs for confirmation of strength/weakness. For example gbp weakness in the above post. Putting all together does give a strong signal."

This morning GBPAUD we have a failed move up around London open with multiple tops, a clean move to the lower range (red line), small retrace and agreement from other GBP pairs (below their moving averages and giving lower highs) showing GBP general weakness. As mentioned several times I like the correlation GBPAUD and GBPNZD when they are agreeing on direction.

Subscribe to:

Posts (Atom)