I'll explain my methods here but go to forexfactory to see these explained with charts, see the "useful links". These are the regular trades I look to enter.

A good trader said to me that the first retracement is the best trade, ie the first higher low/lower high in a move. These retracements provide good opportunities to enter into a move with a relatively small stop loss.

There are 3 trades to consider:

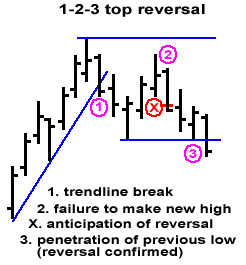

1)Higher lows and lower highs on 5 min charts can be taken at extremes (also known as 1 2 3 tops/bottoms). I would want to see the reversal at a key level ie previous support/resistance area, pivot, round number etc etc.

2)What I'll call 100% system trades that will follow the 1hr with entry from 5 min higher lows and lower highs. I do not want to see an obvious contra indication from 15 min, e.g. I would not want to be selling a 5 min lh immediately after a high vol hammer on 15 min. I would like to be selling a 5 min lh after an engulfing negative close candle/shooting star with little/no lower wick on 15 min.

3)A 2b reversal trade which is a variation of 123 top/bottom and is also an indication of a test and failure. We only look at 2b trades in and around London open, at a key level with a move back into the trend on D.

"In an uptrend, if prices penetrate the previous high but fail to carry through and immediately drop below the previous high, the trend is apt to reverse. The converse is true for downtrends." [Vic Sperandeo in "Trader Vic: Methods of a Wall Street Master"]

General

Some knowledge of candlestick analysis is required as you want to be trading the right candles.

Some of the key items are: consider key levels for turns (eg round numbers, D and W pivots, some fibs), follow the 1hr, are we above or below the 1hr 8 lwma, 5 min hl/lh's. A cross of an 8 lwma on the 5 min chart gives an easy visual clue of a higher low or lower high in most cases. Once set up on 5 min price should move a pip or so beyond the high low of the set up candle to confirm the trade.

NB Watching and trading the right candles is always important. London open typically has a head fake, this turn can happen quickly which is why we look for a decent 15 min candle at least. The pre US session can take a couple of hours to turn and there we need more than a 15 min candle, a good 1hr set up minimum. Avoid weak pre/early US open counter trend candles on 1hr, they are often fake out moves. The 1hr higher low, lower high intra day that reverts to trend is a much better set up.

Always be looking to assess the trend from D, then 1hr flows i.e. 1hr higher lows and lower highs. For example you assess D as downtrend but last 1hr flow is higher high, higher low. Then you have a counter trend rally and might need to wait for 1hr to revert to lower high before selling again.

Stops: Around 15 pips 1.5% of capital. Typically to the last 5 min swing high/low.

Exits: Depends on where you entered in a run. I look to target areas where bounces or turns are likely to occur.

Hi Vantage,

ReplyDeleteGood morning

I just came to your blog and its look great trading system. I have a couple of question regarding the point entry :

1. regarding the 100% setup. do you need to follow LWMA 8 in H1 ?

2. A cross of an 8 lwma on the 5 min chart gives an easy visual clue of a higher low or lower high in most cases <-- do you mean LWMA 8 in 5 min cross with LWMA 8 of H1 ?

Please advise

Thanks a lot,

Monalisa

1. For a 100% system trade, you would be looking for a 1hr candle that gives you a good idea as to direction. You don't want to be fighting against the 15 min chart. A final consideration would be are you above/below the 1hr 8 lwma. You do not need to wait to be the right side of an 1 hr 8 lwma to take a trade though. When all 3 line up (1hr, 15 min, 1hr 8lwma) your success rate is very high.

ReplyDelete2. What I mean there is if the higher time frames are suggesting a trade the last item is a hl/lh on 5 min. The 5 min set up candle should have little/no lower wick in direction of trade. A cross of the 5 min 8 lwma gives an easy visual clue as to a possible trade. For trade entry then the 1 hr 8 lwma has no bearing on the 5 min crossing its own 8 lwma.

Don't forget to follow the link to get rebates on your trades!